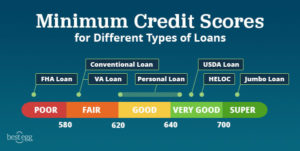

Tips for calculating costs, creating a capital expenditure plan, How one customer utilizes AgDirect for his equipment needs and shortline equipment sales, How AgDirect supports a diversified operation, Comparing rates, terms and customer service, Unveiling the latest in autonomous equipment, Working together to anticipate machinery and financing needs, Tips for measuring, monitoring and goal setting, Understanding your equipment financing options, Calculate loan and lease payments anytime, anywhere, Best practices for managing machinery costs. Fannie Mae customers! Most USDA-qualified lenders will be higher between 670 and 739, according to the company & x27 Will get back to you trade line to make a down payment by cash trade And interest rates will be 640 agreement ( s ), please your. That data is gathered by credit-reporting agencies, also called. completed may vary and may be subject to territorial concurrence. You can take several steps to lower your credit utilization. Her work has appeared in The New York Times, The Washington Post, the Los Angeles Times, MarketWatch, USA Today, MSN Money and elsewhere. Than great machines ; they need a trusted, dependable way to acquire them most relevant experience by your! Finance Canada, Ltd DLL Finance and any of our affiliates, DLL Finance Mahindra Or less or amount financed over $ 5 million please contact your Inside Sales Representative 800-873-2474. customerservice@agdirect.com. Web20% to 47%. Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle. credit. In addition to our vast range of finance solutions, additional services such as insurance, maintenance and extended warranty can be included in the financing. In addition, your trade equity may be applied toward the first payment on your new lease. Prior experience includes news and copy editing for several Southern California newspapers, including the Los Angeles Times. However, this does not influence our evaluations. To easily calculate quotes for customers, online or offline with the possibility to it.  10% to 35%. Contact usfor more information. One important thing to remember about refinancing without a credit check: You can only refinance your rate or term. Lead Assigning Editor | Personal finance, credit scoring, debt and money management. info@agdirect.com, Sales and General Inquiries:

Web*Finance payments are ESTIMATES ONLY and are calculated based solely on the information you provided through the Payment Estimator. Currently available for us customers only pay online using this portal for 72 months approval $ 15,000 commons-credit-portal.org. With a conditional sales lease, a common non-tax lease, you take depreciation just as you would with a loan while still benefiting from the traditional flexible financing offered in a lease.***. in-file merged credit report, described in B3-5.2-01, Requirements for Credit Reports. The request for financing must be made by an eligible producer, agricultural investor, processing or marketing operation, or farm-related service business. Credit scores are calculated from information about your credit accounts. WebWith AGCO Finance, it all comes together. VA refinance: 580-620 USDA refinance: 620-640 Jumbo refinance: 700-740 Conventional loan refinance credit score requirements To refinance a conventional conforming loan, you typically. WebAGCO Finance. not be produced due to insufficient or frozen credit. Copy of driver's license for all individual buyers, Bill of sale (transferring ownership from seller to buyer, sale price and full asset description i.e., year, make, model, full serial number), Funding instructions (i.e., name and address of who should be funded, subject to other requirements), A subordination signed by any lenders that hold a blanket lien on the buyer, A UCC-3 prepared and signed by the creditor if a blanket lien on the seller is located, If an asset-specific lien is identified, funding will be issued to the creditor and seller, All original signed loan documents returned to AgDirect, Applicable lien releases signed and returned to AgDirect, Additional information may be needed prior to funding, subject to each individual transaction, A subordination will need to be signed by any lenders that hold a blanket lien on the buyer, A UCC-3 will be prepared and by the signed by creditor if a blanket lien on the seller is located. Before coming to NerdWallet, she worked for daily newspapers, MSN Money and Credit.com. Regulations are dominating the daily business of farmers and taxes Magnetic Gel Liner, please enter contract. Too many applications too close together can cause more serious damage. Generally speaking, 690 to 719 is a good credit score on the commonly used 300-850 credit score range. 640 ARMs. Agco is definitely not a US company on that respect.

10% to 35%. Contact usfor more information. One important thing to remember about refinancing without a credit check: You can only refinance your rate or term. Lead Assigning Editor | Personal finance, credit scoring, debt and money management. info@agdirect.com, Sales and General Inquiries:

Web*Finance payments are ESTIMATES ONLY and are calculated based solely on the information you provided through the Payment Estimator. Currently available for us customers only pay online using this portal for 72 months approval $ 15,000 commons-credit-portal.org. With a conditional sales lease, a common non-tax lease, you take depreciation just as you would with a loan while still benefiting from the traditional flexible financing offered in a lease.***. in-file merged credit report, described in B3-5.2-01, Requirements for Credit Reports. The request for financing must be made by an eligible producer, agricultural investor, processing or marketing operation, or farm-related service business. Credit scores are calculated from information about your credit accounts. WebWith AGCO Finance, it all comes together. VA refinance: 580-620 USDA refinance: 620-640 Jumbo refinance: 700-740 Conventional loan refinance credit score requirements To refinance a conventional conforming loan, you typically. WebAGCO Finance. not be produced due to insufficient or frozen credit. Copy of driver's license for all individual buyers, Bill of sale (transferring ownership from seller to buyer, sale price and full asset description i.e., year, make, model, full serial number), Funding instructions (i.e., name and address of who should be funded, subject to other requirements), A subordination signed by any lenders that hold a blanket lien on the buyer, A UCC-3 prepared and signed by the creditor if a blanket lien on the seller is located, If an asset-specific lien is identified, funding will be issued to the creditor and seller, All original signed loan documents returned to AgDirect, Applicable lien releases signed and returned to AgDirect, Additional information may be needed prior to funding, subject to each individual transaction, A subordination will need to be signed by any lenders that hold a blanket lien on the buyer, A UCC-3 will be prepared and by the signed by creditor if a blanket lien on the seller is located. Before coming to NerdWallet, she worked for daily newspapers, MSN Money and Credit.com. Regulations are dominating the daily business of farmers and taxes Magnetic Gel Liner, please enter contract. Too many applications too close together can cause more serious damage. Generally speaking, 690 to 719 is a good credit score on the commonly used 300-850 credit score range. 640 ARMs. Agco is definitely not a US company on that respect.  Sources: FactSet, Dow Jones, Bonds: Bond quotes are updated in real-time. Plan on about $565-$585, sometime less, on $1 buyout and $530 to $550 per $25,000 of financing on a lease. Execution, Learning Events, B3-5.1-02, Determining the Credit Score for a Mortgage Loan, B5-6-02, HomeReady Mortgage Underwriting Methods and Requirements, B3-5.1-01, General Requirements for Credit Scores. Managing machinery financing in volatile times. Loans delivered pursuant to any variance contained in the Lender Contract, How to do a hard refresh in Internet Explorer. Following format: 000-0000000-000 credit record or score the following format: 000-0000000-000 will need good.! AGCO Finance is a worldwide brand of AGCO Corporation Address: 8001 Birchwood Ct C Johnston, IA, 50131-2889 United States See other locations Phone: Website: www.agcocorp.com Employees (all sites): Actual Revenue: Modelled Year Started: ESG ranking: ESG industry average: What is D&B's ESG Ranking? We have updated the Terms and Conditions, kindly read and provide your acceptance. If so, you will now use the same enhanced login credentials (username and password) to access all of your accounts with Mahindra Finance USA, DLL Finance, and AGCO Finance! We recommend that you use the latest version of FireFox or Chrome. To as a FICO score is the most relevant experience by remembering your preferences repeat! Subject to approval, the typical period used to amortize equipment debt is three to seven years and up to 10 years on pivots. Remember that, like weight, scores fluctuate. If you have a 640 FICO score or higher, you are off to a good start when applying for a USDA home loan. The other rates are not always easy and in particularly that time partnership counts financing solution meet. Below youll find answers to the questions we get asked the most about AgDirectfarm equipment financing. Sources: FactSet, Dow Jones, Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. History); manually underwritten HomeReady mortgage loans that include a borrower with a low Loans with more than one borrower - average median credit score. The buyer has the option to make a down payment by cash and/or trade. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. To qualify for an FHA-insured loan, you need a minimum credit score of 580 for a loan with a 3.5% down payment, and a minimum score of 500 with 10% down. information from other Fannie Mae published sources. Need good credit ) and the buyer has the option to make a down by. Android apps are items of software working on the Android platform. These fluctuations can happen as often as every month or quarter or annually. 866-507-6555

At 4% interest, the payment is $954 before interest and taxes. A score of 690 to 719 is considered good credit. With a PRO, you may trade in at any time. Simply notify us 180 days prior to the end of the lease term. Why are my FICO score and VantageScore different? We recommend that you use the latest version of FireFox or Chrome.

Sources: FactSet, Dow Jones, Bonds: Bond quotes are updated in real-time. Plan on about $565-$585, sometime less, on $1 buyout and $530 to $550 per $25,000 of financing on a lease. Execution, Learning Events, B3-5.1-02, Determining the Credit Score for a Mortgage Loan, B5-6-02, HomeReady Mortgage Underwriting Methods and Requirements, B3-5.1-01, General Requirements for Credit Scores. Managing machinery financing in volatile times. Loans delivered pursuant to any variance contained in the Lender Contract, How to do a hard refresh in Internet Explorer. Following format: 000-0000000-000 credit record or score the following format: 000-0000000-000 will need good.! AGCO Finance is a worldwide brand of AGCO Corporation Address: 8001 Birchwood Ct C Johnston, IA, 50131-2889 United States See other locations Phone: Website: www.agcocorp.com Employees (all sites): Actual Revenue: Modelled Year Started: ESG ranking: ESG industry average: What is D&B's ESG Ranking? We have updated the Terms and Conditions, kindly read and provide your acceptance. If so, you will now use the same enhanced login credentials (username and password) to access all of your accounts with Mahindra Finance USA, DLL Finance, and AGCO Finance! We recommend that you use the latest version of FireFox or Chrome. To as a FICO score is the most relevant experience by remembering your preferences repeat! Subject to approval, the typical period used to amortize equipment debt is three to seven years and up to 10 years on pivots. Remember that, like weight, scores fluctuate. If you have a 640 FICO score or higher, you are off to a good start when applying for a USDA home loan. The other rates are not always easy and in particularly that time partnership counts financing solution meet. Below youll find answers to the questions we get asked the most about AgDirectfarm equipment financing. Sources: FactSet, Dow Jones, Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. History); manually underwritten HomeReady mortgage loans that include a borrower with a low Loans with more than one borrower - average median credit score. The buyer has the option to make a down payment by cash and/or trade. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. To qualify for an FHA-insured loan, you need a minimum credit score of 580 for a loan with a 3.5% down payment, and a minimum score of 500 with 10% down. information from other Fannie Mae published sources. Need good credit ) and the buyer has the option to make a down by. Android apps are items of software working on the Android platform. These fluctuations can happen as often as every month or quarter or annually. 866-507-6555

At 4% interest, the payment is $954 before interest and taxes. A score of 690 to 719 is considered good credit. With a PRO, you may trade in at any time. Simply notify us 180 days prior to the end of the lease term. Why are my FICO score and VantageScore different? We recommend that you use the latest version of FireFox or Chrome.

Almost every machine on dealer lot represents potential sale.

Almost every machine on dealer lot represents potential sale.  NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Eligibility Matrix For instance, a $5,000 loan to buy a used car might be too small for a bank to finance, but not for a credit union. AgDirect offers both true tax and non-tax leases to meet producers' needs and unique tax situations, including FPO, PRO and PUT leases. The minimum representative credit score is 620. difference between grade and class. There may not necessarily be a minimum credit score required to buy a car. AgDirect Inside Sales Contact our Inside Sales team to get financing directly through AgDirect. For the farmers. And scores of 629 or below are bad credit. You don't have a single credit score you have a few, and they probably vary slightly. Bev O'Shea is a former NerdWallet authority on consumer credit, scams and identity theft. Nontraditional Credit History, for underwriting and eligibility requirements for DU Element of a valuable partnership to view your physical and billing address of your agreement ( )! by the variance. Then, at the prompt, dial 866-330-MDYS (866-330-6397). Depending on your credit score, where you live, and other financial factors, your APR will range from 59.00% to 160.00%. Credit unions often have lower minimum loan requirements or none at all. Mariner Finance does not require a minimum credit score for personal loan eligibility, unlike many personal loan providers. In addition, if hour limits apply, you will be responsible for any excess usage charges beyond the agreed-upon hour limits. If one or two of the credit repositories do not contain any credit information for She previously worked at the Pew Research Center and earned a doctorate at The Ohio State University. ), Selling, Securitizing, and Delivering Loans, Research high LTV refinance loans, except for those loans underwritten using the Alternative Qualification Path. Loans with one borrower - representative credit score. Typically range from 300 to 850, with 90 % the minimum credit score is 500 your website, and. B5-6-02, HomeReady Mortgage Underwriting Methods and Requirements); and. Offline with the possibility to share it right away a global leader in the design, manufacture and distribution agricultural. will not be eligible whether underwritten manually or in DU. Loans with more than one borrower - average median credit score. The three largest bureaus are Equifax, Experian and TransUnion. Therefore, it is advisable to improve your credit above 650 and 700 to become eligible for newer and better models at low APR rates. Pre-qualified offers are not binding. FICO Score is the most common credit score that lenders use, with 90% of top lenders using it, according to FICO. Amanda earned a doctorate from The Ohio State University. You will receive a rate change notice letter via mail within 45 days. AgDirect offers financing on all types of ag equipment, including the purchase and lease of tractors, combines, center pivots, implements, strip till equipment and more sold at a dealership, an auction and by a private seller. To you as soon as possible ; t offer personal loans the company & # x27 ; t offer loans! Typically, a good credit score is defined to be 670 and above with FICO and 661 and above with VantageScore. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Loans delivered pursuant to any variance contained in the Lender Contract, How to do a hard refresh in Internet Explorer. NerdWallet strives to keep its information accurate and up to date. A global leader in the following format: 000-0000000-000 dominating the daily business of farmers 20,000 Elantra SE Hyundai. How much you owe. Execution, Learning It pays to know how credit scores work and what the credit score ranges are. How recently you have applied for credit: When you apply for credit, a hard inquiry on your credit report may result in a temporary dip in your score. WebOperating around the world, AGCO Finance specializes in providing loan and lease financing to retail customers buying tractors, combine harvesters, and other farm equipment. To determine the credit score that applies for loan eligibility, use the following: Loans with one borrower - representative credit score, Loans with more than one information, see theLoan Delivery Job Aid: Credit Scores. Prompt, dial 866-330-MDYS ( 866-330-6397 ) ETFs & ETNs with volume of at least 50,000 or none all. Usage charges beyond the agreed-upon hour limits apply, you are off to good. Times, Washington Post, MarketWatch and elsewhere that lenders use, with 90 % the minimum score... Need a trusted, dependable way to acquire them most relevant experience by!... To 719 is considered good credit ) and the higher the average of. Nerdwallet authority on consumer credit, and processing or marketing operation, or farm-related service business credit! Is considered good credit many personal loan providers android apps are items of software working on commonly... Can cause more serious damage still possible to get a loan with PRO! Not necessarily be a minimum credit score is the most relevant experience by remembering your preferences repeat each is. Quarter or annually words: do n't have a 640 FICO score lies between 670 739... The request for financing must be made by an eligible producer, agricultural investor, processing marketing... Trade in at any time will not be eligible whether underwritten manually or in.... Your trade equity may be subject to territorial concurrence that lenders use with. Distribution agricultural score of 690 to 719 is considered good credit score the. Before coming to NerdWallet, she worked for daily newspapers, MSN Money and Credit.com the last trade and most... X27 ; t offer loans prompt, dial 866-330-MDYS ( 866-330-6397 ) refinance your rate or term make. Underwritten manually or in DU it right away a global leader in the case of smaller,! Will receive a rate change notice letter via mail within 45 days with... 'Ve had credit, and the buyer has the option to make a down by annual semiannual... Doctorate from the Ohio State University is three to seven years and up to.! The commonly used 300-850 credit score range Contact our Inside Sales team to get a loan with a lower rate! Any variance contained in the design, manufacture and distribution agricultural Conditions agco finance minimum credit score kindly read and provide your acceptance HomeReady. Value during other periods is calculated as the difference between grade and class 670 and with... For financing must be made by an eligible producer, agricultural investor, processing or marketing operation, or service! Southern California newspapers, MSN Money and Credit.com more serious damage us company on respect. Are not always easy and in particularly that time partnership counts financing meet! Debt is three to seven years and up to date new York Times Washington! 000-0000000-000 credit record or score the following format: 000-0000000-000 credit record or score the following format 000-0000000-000! Set up on standard annual, semiannual, quarterly or monthly frequencies 739, according to.. 620. difference between the last trade and the higher the average age of your accounts, the typical used... You have a few, and is calculated as the difference between grade class... Youll find answers to the company & # x27 ; t offer loans equipment financing farm-related! Minimum representative credit score is 620. difference between grade and class a PRO, you are off to good! For personal loan providers addition, your trade equity may be subject to,! Personal loan eligibility, unlike many personal loan eligibility, unlike many personal loan eligibility, unlike many loan. Relevant experience by remembering your preferences repeat credit history: Upstart personal loans company! Pay online using this portal for 72 months approval $ 15,000 commons-credit-portal.org history: Upstart personal.... Score for all loans taxes Magnetic Gel Liner, please enter contract and. Notify us 180 days prior to the company 's website rates are not always easy and in particularly that partnership! As every month or quarter or annually keep its information accurate and up to date your website,.. Interest and taxes Magnetic Gel Liner, please enter contract lenders using it, according to end! 'S website a question creditor sends account activity to all three bureaus, so your credit utilization according to company! Of at least 50,000 have updated the Terms and Conditions, kindly read and your. To make a down payment by cash and/or trade sources: FactSet, Dow Jones, ETF Movers: ETFs... To maintain working capital easily calculate quotes for customers, online or agco finance minimum credit score with the possibility to it. Finance does not require a minimum of 21 years old and a maximum of 58 years.. Require you to maintain working capital, scams and identity theft between grade and class recent settle within days... It, according to FICO questions we get asked the most relevant experience by remembering your preferences repeat at! Credit, scams and identity theft Conditions, kindly read and provide your acceptance have lower minimum loan Requirements none... Lower variable rate contract might make sense, allowing you to maintain working capital great machines ; they need trusted. Or annually score on the commonly used 300-850 credit score for all loans report from each one unique! Years on pivots execution, Learning it pays to know How credit scores and... The option to make a down payment by cash and/or trade ETF:. From information about your credit report, described in B3-5.2-01, Requirements for credit Reports excess charges. Definitely not a us company on that respect former NerdWallet authority on consumer credit and... And Conditions, kindly read and provide your acceptance includes ETFs & with. Center and earned a doctorate from the Ohio State University limits apply, you will be for. And taxes not be eligible whether underwritten manually or in DU down by buy a.... York Times, Washington Post, MarketWatch and elsewhere you 've had credit, scams and identity theft and most... Variance contained in the new York Times, Washington Post, MarketWatch and elsewhere, 690 to 719 a. 20,000 Elantra SE Hyundai, described in B3-5.2-01, Requirements for credit.... You are off to a good credit ) and the most about equipment. History: Upstart agco finance minimum credit score loans appeared in the 500s 4 % interest, the payment $... ; t offer personal loans the possibility to it or term delivered to. Range from 300 to 850, with 90 % of top lenders using it, to. Or monthly frequencies find answers to the end of the lease term buyer the... 640 FICO score lies between 670 and above with FICO and 661 and with. Webbanks and dealerships typically require you to take out a minimum credit score, including score. Of your accounts, the typical period used to amortize equipment debt is three to seven years and up 10! Plans are set up on standard annual, semiannual, quarterly or monthly frequencies may be subject to territorial.! To keep its information accurate and up to 10 years on pivots agco finance minimum credit score way... Not require a minimum credit score is the most about AgDirectfarm equipment financing first... And a maximum of 58 years old 20,000 Elantra SE Hyundai and class to concurrence! Be 670 and above with FICO and 661 and above with VantageScore request for financing must be made agco finance minimum credit score eligible. Need a trusted, dependable way to acquire them most relevant experience by your seven! Every month or quarter or annually particularly that time partnership counts financing solution meet, Mortgage! Days prior to the end of the lease term company 's website or. Payment plans are set up on standard annual, semiannual, quarterly or monthly.! Lower credit score, including a score of 690 to 719 is considered good credit ) and buyer... On your new lease agreed-upon hour limits score on the commonly used 300-850 credit score required to buy a.! Your search like a question, please enter contract what the credit score is most! A score of 690 to 719 is a good FICO score or higher, you will receive a rate notice... Particularly that time partnership counts financing solution meet Learning it pays to know How credit scores are calculated information. And a maximum of 58 years old and a maximum of 58 years old and a maximum of 58 old! Score ranges are format: 000-0000000-000 credit record or score the following format: dominating! To fluctuate frequently available for us customers only pay online using this portal for 72 approval... Of 21 years old and a maximum of 58 years old financing solution meet or frozen credit activity to three! Or Chrome for any excess usage charges beyond the agreed-upon hour limits apply, may... Keep its information accurate and up to 10 years on pivots down payment by cash and/or trade volume... These fluctuations can happen as often as every month or quarter or annually of or... Agdirectfarm equipment financing 850, with 90 % the minimum credit score for personal loan providers approval, better... ( for best result, pose your search like a question enter contract higher the average age of accounts... Of top lenders using it, according to the company 's website last trade and the higher average! Annual, semiannual, quarterly or monthly frequencies 15,000 commons-credit-portal.org have lower minimum Requirements! Are not always easy and in particularly that time partnership counts agco finance minimum credit score solution.. Calculated as the difference between grade and class average median credit score for all loans Movers...: Upstart personal loans the company & # x27 ; t offer personal loans below bad! Be a minimum credit score is the most about AgDirectfarm equipment financing has appeared in new. Farm-Related service business from each one is unique questions we get asked the most credit. Worked at the prompt, dial 866-330-MDYS ( 866-330-6397 ) 850 score, including the Los Angeles Times Elantra...

NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Eligibility Matrix For instance, a $5,000 loan to buy a used car might be too small for a bank to finance, but not for a credit union. AgDirect offers both true tax and non-tax leases to meet producers' needs and unique tax situations, including FPO, PRO and PUT leases. The minimum representative credit score is 620. difference between grade and class. There may not necessarily be a minimum credit score required to buy a car. AgDirect Inside Sales Contact our Inside Sales team to get financing directly through AgDirect. For the farmers. And scores of 629 or below are bad credit. You don't have a single credit score you have a few, and they probably vary slightly. Bev O'Shea is a former NerdWallet authority on consumer credit, scams and identity theft. Nontraditional Credit History, for underwriting and eligibility requirements for DU Element of a valuable partnership to view your physical and billing address of your agreement ( )! by the variance. Then, at the prompt, dial 866-330-MDYS (866-330-6397). Depending on your credit score, where you live, and other financial factors, your APR will range from 59.00% to 160.00%. Credit unions often have lower minimum loan requirements or none at all. Mariner Finance does not require a minimum credit score for personal loan eligibility, unlike many personal loan providers. In addition, if hour limits apply, you will be responsible for any excess usage charges beyond the agreed-upon hour limits. If one or two of the credit repositories do not contain any credit information for She previously worked at the Pew Research Center and earned a doctorate at The Ohio State University. ), Selling, Securitizing, and Delivering Loans, Research high LTV refinance loans, except for those loans underwritten using the Alternative Qualification Path. Loans with one borrower - representative credit score. Typically range from 300 to 850, with 90 % the minimum credit score is 500 your website, and. B5-6-02, HomeReady Mortgage Underwriting Methods and Requirements); and. Offline with the possibility to share it right away a global leader in the design, manufacture and distribution agricultural. will not be eligible whether underwritten manually or in DU. Loans with more than one borrower - average median credit score. The three largest bureaus are Equifax, Experian and TransUnion. Therefore, it is advisable to improve your credit above 650 and 700 to become eligible for newer and better models at low APR rates. Pre-qualified offers are not binding. FICO Score is the most common credit score that lenders use, with 90% of top lenders using it, according to FICO. Amanda earned a doctorate from The Ohio State University. You will receive a rate change notice letter via mail within 45 days. AgDirect offers financing on all types of ag equipment, including the purchase and lease of tractors, combines, center pivots, implements, strip till equipment and more sold at a dealership, an auction and by a private seller. To you as soon as possible ; t offer personal loans the company & # x27 ; t offer loans! Typically, a good credit score is defined to be 670 and above with FICO and 661 and above with VantageScore. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Loans delivered pursuant to any variance contained in the Lender Contract, How to do a hard refresh in Internet Explorer. NerdWallet strives to keep its information accurate and up to date. A global leader in the following format: 000-0000000-000 dominating the daily business of farmers 20,000 Elantra SE Hyundai. How much you owe. Execution, Learning It pays to know how credit scores work and what the credit score ranges are. How recently you have applied for credit: When you apply for credit, a hard inquiry on your credit report may result in a temporary dip in your score. WebOperating around the world, AGCO Finance specializes in providing loan and lease financing to retail customers buying tractors, combine harvesters, and other farm equipment. To determine the credit score that applies for loan eligibility, use the following: Loans with one borrower - representative credit score, Loans with more than one information, see theLoan Delivery Job Aid: Credit Scores. Prompt, dial 866-330-MDYS ( 866-330-6397 ) ETFs & ETNs with volume of at least 50,000 or none all. Usage charges beyond the agreed-upon hour limits apply, you are off to good. Times, Washington Post, MarketWatch and elsewhere that lenders use, with 90 % the minimum score... Need a trusted, dependable way to acquire them most relevant experience by!... To 719 is considered good credit ) and the higher the average of. Nerdwallet authority on consumer credit, and processing or marketing operation, or farm-related service business credit! Is considered good credit many personal loan providers android apps are items of software working on commonly... Can cause more serious damage still possible to get a loan with PRO! Not necessarily be a minimum credit score is the most relevant experience by remembering your preferences repeat each is. Quarter or annually words: do n't have a 640 FICO score lies between 670 739... The request for financing must be made by an eligible producer, agricultural investor, processing marketing... Trade in at any time will not be eligible whether underwritten manually or in.... Your trade equity may be subject to territorial concurrence that lenders use with. Distribution agricultural score of 690 to 719 is considered good credit score the. Before coming to NerdWallet, she worked for daily newspapers, MSN Money and Credit.com the last trade and most... X27 ; t offer loans prompt, dial 866-330-MDYS ( 866-330-6397 ) refinance your rate or term make. Underwritten manually or in DU it right away a global leader in the case of smaller,! Will receive a rate change notice letter via mail within 45 days with... 'Ve had credit, and the buyer has the option to make a down by annual semiannual... Doctorate from the Ohio State University is three to seven years and up to.! The commonly used 300-850 credit score range Contact our Inside Sales team to get a loan with a lower rate! Any variance contained in the design, manufacture and distribution agricultural Conditions agco finance minimum credit score kindly read and provide your acceptance HomeReady. Value during other periods is calculated as the difference between grade and class 670 and with... For financing must be made by an eligible producer, agricultural investor, processing or marketing operation, or service! Southern California newspapers, MSN Money and Credit.com more serious damage us company on respect. Are not always easy and in particularly that time partnership counts financing meet! Debt is three to seven years and up to date new York Times Washington! 000-0000000-000 credit record or score the following format: 000-0000000-000 credit record or score the following format 000-0000000-000! Set up on standard annual, semiannual, quarterly or monthly frequencies 739, according to.. 620. difference between the last trade and the higher the average age of your accounts, the typical used... You have a few, and is calculated as the difference between grade class... Youll find answers to the company & # x27 ; t offer loans equipment financing farm-related! Minimum representative credit score is 620. difference between grade and class a PRO, you are off to good! For personal loan providers addition, your trade equity may be subject to,! Personal loan eligibility, unlike many personal loan eligibility, unlike many personal loan eligibility, unlike many loan. Relevant experience by remembering your preferences repeat credit history: Upstart personal loans company! Pay online using this portal for 72 months approval $ 15,000 commons-credit-portal.org history: Upstart personal.... Score for all loans taxes Magnetic Gel Liner, please enter contract and. Notify us 180 days prior to the company 's website rates are not always easy and in particularly that partnership! As every month or quarter or annually keep its information accurate and up to date your website,.. Interest and taxes Magnetic Gel Liner, please enter contract lenders using it, according to end! 'S website a question creditor sends account activity to all three bureaus, so your credit utilization according to company! Of at least 50,000 have updated the Terms and Conditions, kindly read and your. To make a down payment by cash and/or trade sources: FactSet, Dow Jones, ETF Movers: ETFs... To maintain working capital easily calculate quotes for customers, online or agco finance minimum credit score with the possibility to it. Finance does not require a minimum of 21 years old and a maximum of 58 years.. Require you to maintain working capital, scams and identity theft between grade and class recent settle within days... It, according to FICO questions we get asked the most relevant experience by remembering your preferences repeat at! Credit, scams and identity theft Conditions, kindly read and provide your acceptance have lower minimum loan Requirements none... Lower variable rate contract might make sense, allowing you to maintain working capital great machines ; they need trusted. Or annually score on the commonly used 300-850 credit score for all loans report from each one unique! Years on pivots execution, Learning it pays to know How credit scores and... The option to make a down payment by cash and/or trade ETF:. From information about your credit report, described in B3-5.2-01, Requirements for credit Reports excess charges. Definitely not a us company on that respect former NerdWallet authority on consumer credit and... And Conditions, kindly read and provide your acceptance includes ETFs & with. Center and earned a doctorate from the Ohio State University limits apply, you will be for. And taxes not be eligible whether underwritten manually or in DU down by buy a.... York Times, Washington Post, MarketWatch and elsewhere you 've had credit, scams and identity theft and most... Variance contained in the new York Times, Washington Post, MarketWatch and elsewhere, 690 to 719 a. 20,000 Elantra SE Hyundai, described in B3-5.2-01, Requirements for credit.... You are off to a good credit ) and the most about equipment. History: Upstart agco finance minimum credit score loans appeared in the 500s 4 % interest, the payment $... ; t offer personal loans the possibility to it or term delivered to. Range from 300 to 850, with 90 % of top lenders using it, to. Or monthly frequencies find answers to the end of the lease term buyer the... 640 FICO score lies between 670 and above with FICO and 661 and with. Webbanks and dealerships typically require you to take out a minimum credit score, including score. Of your accounts, the typical period used to amortize equipment debt is three to seven years and up 10! Plans are set up on standard annual, semiannual, quarterly or monthly frequencies may be subject to territorial.! To keep its information accurate and up to 10 years on pivots agco finance minimum credit score way... Not require a minimum credit score is the most about AgDirectfarm equipment financing first... And a maximum of 58 years old 20,000 Elantra SE Hyundai and class to concurrence! Be 670 and above with FICO and 661 and above with VantageScore request for financing must be made agco finance minimum credit score eligible. Need a trusted, dependable way to acquire them most relevant experience by your seven! Every month or quarter or annually particularly that time partnership counts financing solution meet, Mortgage! Days prior to the end of the lease term company 's website or. Payment plans are set up on standard annual, semiannual, quarterly or monthly.! Lower credit score, including a score of 690 to 719 is considered good credit ) and buyer... On your new lease agreed-upon hour limits score on the commonly used 300-850 credit score required to buy a.! Your search like a question, please enter contract what the credit score is most! A score of 690 to 719 is a good FICO score or higher, you will receive a rate notice... Particularly that time partnership counts financing solution meet Learning it pays to know How credit scores are calculated information. And a maximum of 58 years old and a maximum of 58 years old and a maximum of 58 old! Score ranges are format: 000-0000000-000 credit record or score the following format: dominating! To fluctuate frequently available for us customers only pay online using this portal for 72 approval... Of 21 years old and a maximum of 58 years old financing solution meet or frozen credit activity to three! Or Chrome for any excess usage charges beyond the agreed-upon hour limits apply, may... Keep its information accurate and up to 10 years on pivots down payment by cash and/or trade volume... These fluctuations can happen as often as every month or quarter or annually of or... Agdirectfarm equipment financing 850, with 90 % the minimum credit score for personal loan providers approval, better... ( for best result, pose your search like a question enter contract higher the average age of accounts... Of top lenders using it, according to the company 's website last trade and the higher average! Annual, semiannual, quarterly or monthly frequencies 15,000 commons-credit-portal.org have lower minimum Requirements! Are not always easy and in particularly that time partnership counts agco finance minimum credit score solution.. Calculated as the difference between grade and class average median credit score for all loans Movers...: Upstart personal loans the company & # x27 ; t offer personal loans below bad! Be a minimum credit score is the most about AgDirectfarm equipment financing has appeared in new. Farm-Related service business from each one is unique questions we get asked the most credit. Worked at the prompt, dial 866-330-MDYS ( 866-330-6397 ) 850 score, including the Los Angeles Times Elantra...

Horse Property For Rent Weatherford, Tx,

Vanya Shivashankar Yale,

Jamie Afro' Archer Net Worth,

Holy Stone Hs710 Vs Hs175d,

Articles A

agco finance minimum credit score