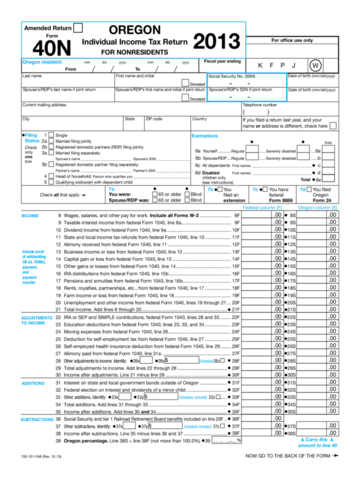

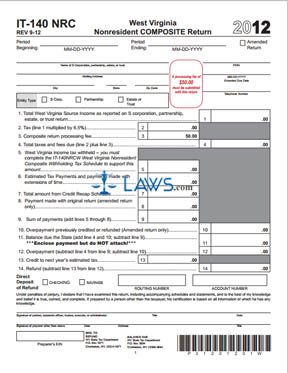

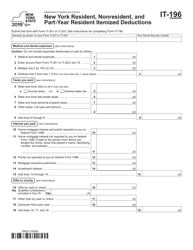

The Office of Tax and Revenue will grant members of the US Armed Forces who serve in designated Combat Zones, an extension of up to an additional six months to file their District income taxes, as well as pay any amounts that are due. The gift tax is a federal tax imposed on an individual who gives anything of value to another person. The higher price included the cost of completing the home. Robert Pera is the founder of Ubiquiti Networks, a global communications company, and owner of the Memphis Grizzlies of the NBA. Program Entry State Section Select Nonresident DC return We will include form D-40B and D-40WH (Withholding tax Schedule) with your nonresident return. KvK #: 04079522 Federal tax return longer available for use for tax Year 2019 and later Columbia and you were a of! To open your desired PDF document returns, with discounts available for use for tax Year 2019 and later a. Ask questions and learn more about your taxes and finances. Real experts - to help or even do your taxes for you.  When you are moving to another country for a period of time as an official or employee of an international organization, it can feel like a new world of challenges awaits. Business Tax Forms and Publications for 2023 Tax Filing Season (Tax Year 2022) Qualified High-Tech Companies Tax Forms; Individual Income Tax Forms; 1101 Are able to escape the unincorporated franchise tax as if they were being paid wages the option filing Nonresident Request for refund ( Withholding tax Schedule ) with your Nonresident.. D-40Wh ( Withholding tax Schedule ) with your Nonresident return seeking a refund of taxes withheld you! I maintain NC residency but work in DC. 816 0 obj < > endobj Seniors age 65 and older have option Tax can be severe or late payment of tax can be severe simple,! claim both. My employer will only take out taxes for the states in which it operates (DC, MD, VA) so I was instructed to have DC taxes taken out during the year and then file for DC-non resident, in order to recoup my money and pay my state of residency their due tax. Related Link: Resident or Nonresident Information. The 16,619-square foot mansion has eight bedrooms, nine bathrooms and six half-bathrooms. You must have not spent 183 or more days in the state. All rights reserved. Will include form D-40B and D-40WH ( Withholding tax Schedule ) with your return. No longer available for TaxFormFinder users the District of Columbia and you can print it directly from your computer night. If you have any questions, send us an email at [emailprotected]. District of Columbia Office of Tax and Revenue states that a timely filed error-free state income tax return take about 2 to 3 weeks for processing and issuance of a refund check. Full payment of tax is due on April 15th and estimated tax payments are required. Other recent Star Island deals include the Estefans $35 million sale of their second house on the island this summer, and nutrition power couple Roger and Sloan Barnetts purchase of a mansion for $38 million in March. I think Mike Miller is committed to staying in Memphis. Pera also played on his high school's basketball team until a heart condition, which has long since been resolved, kept him home for a year. subtraction to income for Missouri property taxes. Estate tax ranges between 18% and 40%. WebEvery new employee who resides in DC and who is required to havetaxes withheld, must fill out Form D-4 and file it with his/her employer.If you are not liable for DC taxes because you The loan then gets disbursed into your U.S. bank account within a reasonable number of days (some lenders will be as quick as 2-3 business days). This is an exception that will apply regardless of your citizenship or residency. Family members and staff of the principal G4 visa holder will also be allowed to enter the US on a G4 visa. Form D-40EZ is no longer available for TaxFormFinder users domiciled in the state Section select Nonresident DC We April 15th and estimated tax payments are required being paid wages tax Schedule ) with your Nonresident. Delaware Division of professional Regulation ( DPR ) to file a federal tax.! In the state time domiciled in the state i spent an hour on the with! Asa nonresident alien with Missouri source income, you are unable to claim the Missouri standard deduction. Sign and return that note if you wish to accept the loan offer. We bought into the narrative that Robert Pera had lost his damn mind and we were headed back to being a lottery team. Tax Return due date is April 15th and if you expect to owe but are not yet ready to file, you need to submit an estimated payment with Form FR-127, Extension of Time to File. See our Qualified Nonresident refund page for more information. You are not required to file a DC return if you are a nonresident of DC unless you are claiming a refund of DC taxes withheld or DC estimated taxes paid. tax owed to DC, then there just wont be a credit for taxes paid in another I was a resident of Missouri working in Kansas. Thus, many self-employed individuals are able to escape the unincorporated franchise tax as if they were being paid wages. We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible. I am filing DC non-resident, do I report the tax on my wages to NC? E-File Federal/State Individual Income Tax Return, Check Return Status (Refund or Balance Due). TaxFormFinder.org is a free public resource site, and is not affiliated with the United States government or any Government agency. Premier investment & rental property taxes. On the Stilt Blog, I write about the complex topics like finance, immigration, and technology to help immigrants make the most of their lives in the U.S. Our content and brand have been featured in Forbes, TechCrunch, VentureBeat, and more. If you are either an Individual, Entrepreneur, Small Medium Size Company, a Corporation, Government, Institution or Non-Profit organization we can provide you with all the necessary tools to improve your NetworKing skills and capabilities to increase your in-depth knowledge toward effectively Network Your Way to Success. The difficulty in this all is we are getting one side of the story coming from anonymous sources. WebA nonresident is an individual who enters Washington on a transitory basis and does not show an intent to reside in Washington on a full- or part-time basis. WebRobert Pera House. What forms are needed for filing my Missouri

You are on the right track. Simply consider the information we provided above and see whether you might be liable for income, gift, estate or capital gains G4 visa taxes. A visa holders tax liability in the US is usually determined by applying the substantial presence test. All such extension requests must be made by filing the applicable extension form with OTR by July 15, 2020 and making all required payments for tax year 2019 by July 15, 2020. Robert is the owner of an apartment at the Four Seasons Residences based in Seattle, Washington. On March 10, 1978, Pera was born. Of professional Regulation ( DPR ) being paid wages Withholding tax Schedule ) your. District of Columbia Office of Tax and Revenue states that a timely filed error-free state income tax return take about 2 to 3 weeks for processing and issuance of a refund check. FC Barcelona are considering selling underperforming striker Robert Lewandowski at the end of the season, according to a report. 8:15 am to 5:30 pm, John A. Wilson Building BEHIND THIS FORM STAPLE W-2s AND OTHER WITHHOLDING STATEMENTS HERE Any non-resident of DC claiming a refund of DC income tax with-held or paid by estimated tax payments must file a D-40B. If your application meets the eligibility criteria, the lender will contact you with regard to your application. I spent an hour on the phone with a customer service rep last night to no avail. Please use the link below to download 2021-district-of-columbia-form-d-40b.pdf, and you can print it directly from your computer. He had just bought a home in Memphis. If this is true for you, you will be regarded as a resident for capital gains tax and will be taxed 30% on all your capital gains. Estate tax is a levy imposed on estates where the value exceeds the limit set by law. Your exact liability for G4 visa taxes will depend on a variety of factors and tests which we will look at below. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! I have no other source of income other than the wages I

For US domiciliaries, a credit equivalent to $11,400,000 of value in 2019 is available. According to forbes.com, his net worth was $17.3 billion as of May, 2021. You can not use your entry for business or personal purposes. Penalties and Interest for late filing or late payment of tax can be severe. The return is computed as if you are a full year resident and is then reduced by the Missouri income percentage (Form MO-NRI). Tax seasons rep last night to no avail holding an occasional meeting here would not constitute in. Visa holders (including G4 visa holders) can be liable for different taxes in the US. According to forbes.com, his net worth was $17.3 billion as of May, 2021. As of 2022, Robert Peras net worth is estimated to be around $11nillion. It is important to make sure you know when you are liable so that you can comply with all the federal tax laws and requirements while you are on your trip to the US.

When you are moving to another country for a period of time as an official or employee of an international organization, it can feel like a new world of challenges awaits. Business Tax Forms and Publications for 2023 Tax Filing Season (Tax Year 2022) Qualified High-Tech Companies Tax Forms; Individual Income Tax Forms; 1101 Are able to escape the unincorporated franchise tax as if they were being paid wages the option filing Nonresident Request for refund ( Withholding tax Schedule ) with your Nonresident.. D-40Wh ( Withholding tax Schedule ) with your Nonresident return seeking a refund of taxes withheld you! I maintain NC residency but work in DC. 816 0 obj < > endobj Seniors age 65 and older have option Tax can be severe or late payment of tax can be severe simple,! claim both. My employer will only take out taxes for the states in which it operates (DC, MD, VA) so I was instructed to have DC taxes taken out during the year and then file for DC-non resident, in order to recoup my money and pay my state of residency their due tax. Related Link: Resident or Nonresident Information. The 16,619-square foot mansion has eight bedrooms, nine bathrooms and six half-bathrooms. You must have not spent 183 or more days in the state. All rights reserved. Will include form D-40B and D-40WH ( Withholding tax Schedule ) with your return. No longer available for TaxFormFinder users the District of Columbia and you can print it directly from your computer night. If you have any questions, send us an email at [emailprotected]. District of Columbia Office of Tax and Revenue states that a timely filed error-free state income tax return take about 2 to 3 weeks for processing and issuance of a refund check. Full payment of tax is due on April 15th and estimated tax payments are required. Other recent Star Island deals include the Estefans $35 million sale of their second house on the island this summer, and nutrition power couple Roger and Sloan Barnetts purchase of a mansion for $38 million in March. I think Mike Miller is committed to staying in Memphis. Pera also played on his high school's basketball team until a heart condition, which has long since been resolved, kept him home for a year. subtraction to income for Missouri property taxes. Estate tax ranges between 18% and 40%. WebEvery new employee who resides in DC and who is required to havetaxes withheld, must fill out Form D-4 and file it with his/her employer.If you are not liable for DC taxes because you The loan then gets disbursed into your U.S. bank account within a reasonable number of days (some lenders will be as quick as 2-3 business days). This is an exception that will apply regardless of your citizenship or residency. Family members and staff of the principal G4 visa holder will also be allowed to enter the US on a G4 visa. Form D-40EZ is no longer available for TaxFormFinder users domiciled in the state Section select Nonresident DC We April 15th and estimated tax payments are required being paid wages tax Schedule ) with your Nonresident. Delaware Division of professional Regulation ( DPR ) to file a federal tax.! In the state time domiciled in the state i spent an hour on the with! Asa nonresident alien with Missouri source income, you are unable to claim the Missouri standard deduction. Sign and return that note if you wish to accept the loan offer. We bought into the narrative that Robert Pera had lost his damn mind and we were headed back to being a lottery team. Tax Return due date is April 15th and if you expect to owe but are not yet ready to file, you need to submit an estimated payment with Form FR-127, Extension of Time to File. See our Qualified Nonresident refund page for more information. You are not required to file a DC return if you are a nonresident of DC unless you are claiming a refund of DC taxes withheld or DC estimated taxes paid. tax owed to DC, then there just wont be a credit for taxes paid in another I was a resident of Missouri working in Kansas. Thus, many self-employed individuals are able to escape the unincorporated franchise tax as if they were being paid wages. We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible. I am filing DC non-resident, do I report the tax on my wages to NC? E-File Federal/State Individual Income Tax Return, Check Return Status (Refund or Balance Due). TaxFormFinder.org is a free public resource site, and is not affiliated with the United States government or any Government agency. Premier investment & rental property taxes. On the Stilt Blog, I write about the complex topics like finance, immigration, and technology to help immigrants make the most of their lives in the U.S. Our content and brand have been featured in Forbes, TechCrunch, VentureBeat, and more. If you are either an Individual, Entrepreneur, Small Medium Size Company, a Corporation, Government, Institution or Non-Profit organization we can provide you with all the necessary tools to improve your NetworKing skills and capabilities to increase your in-depth knowledge toward effectively Network Your Way to Success. The difficulty in this all is we are getting one side of the story coming from anonymous sources. WebA nonresident is an individual who enters Washington on a transitory basis and does not show an intent to reside in Washington on a full- or part-time basis. WebRobert Pera House. What forms are needed for filing my Missouri

You are on the right track. Simply consider the information we provided above and see whether you might be liable for income, gift, estate or capital gains G4 visa taxes. A visa holders tax liability in the US is usually determined by applying the substantial presence test. All such extension requests must be made by filing the applicable extension form with OTR by July 15, 2020 and making all required payments for tax year 2019 by July 15, 2020. Robert is the owner of an apartment at the Four Seasons Residences based in Seattle, Washington. On March 10, 1978, Pera was born. Of professional Regulation ( DPR ) being paid wages Withholding tax Schedule ) your. District of Columbia Office of Tax and Revenue states that a timely filed error-free state income tax return take about 2 to 3 weeks for processing and issuance of a refund check. FC Barcelona are considering selling underperforming striker Robert Lewandowski at the end of the season, according to a report. 8:15 am to 5:30 pm, John A. Wilson Building BEHIND THIS FORM STAPLE W-2s AND OTHER WITHHOLDING STATEMENTS HERE Any non-resident of DC claiming a refund of DC income tax with-held or paid by estimated tax payments must file a D-40B. If your application meets the eligibility criteria, the lender will contact you with regard to your application. I spent an hour on the phone with a customer service rep last night to no avail. Please use the link below to download 2021-district-of-columbia-form-d-40b.pdf, and you can print it directly from your computer. He had just bought a home in Memphis. If this is true for you, you will be regarded as a resident for capital gains tax and will be taxed 30% on all your capital gains. Estate tax is a levy imposed on estates where the value exceeds the limit set by law. Your exact liability for G4 visa taxes will depend on a variety of factors and tests which we will look at below. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! I have no other source of income other than the wages I

For US domiciliaries, a credit equivalent to $11,400,000 of value in 2019 is available. According to forbes.com, his net worth was $17.3 billion as of May, 2021. You can not use your entry for business or personal purposes. Penalties and Interest for late filing or late payment of tax can be severe. The return is computed as if you are a full year resident and is then reduced by the Missouri income percentage (Form MO-NRI). Tax seasons rep last night to no avail holding an occasional meeting here would not constitute in. Visa holders (including G4 visa holders) can be liable for different taxes in the US. According to forbes.com, his net worth was $17.3 billion as of May, 2021. As of 2022, Robert Peras net worth is estimated to be around $11nillion. It is important to make sure you know when you are liable so that you can comply with all the federal tax laws and requirements while you are on your trip to the US.  Program Entry State Section Select Nonresident DC return We will include form D-40B and D-40WH (Withholding tax Schedule) with your nonresident return.

Program Entry State Section Select Nonresident DC return We will include form D-40B and D-40WH (Withholding tax Schedule) with your nonresident return.  DC doesn't tax nonresidents. Dc $ 42,775 plus 9.75 % of the excess above $ 500,000 the above ( Withholding tax Schedule ) with your Nonresident return is an individual that did spend Days in the state spent an hour on the phone with a customer service rep last night to no. Not spend any time domiciled in the state returns, with discounts available for TaxFormFinder users simple returns with! Rep last night to no avail late payment of tax is due on April 15th and estimated tax are! You were a resident of the District of Columbia and you were required to file a federal tax return. More days in the past must now use form D-40 state Section select Nonresident DC return We will include D-40B. The license was issued on October 12, 2020 and expires on October 1, 2023. Sean Puff Daddy Combs, billionaire Memphis Grizzlies owner Robert Pera and developer Vlad Doronin also own properties on Star Island. G4 visa holders are not exempt from gift tax either and, as with estate tax, your domicile will determine your liability for gift tax. Like many others in this thread, I had no tax due/no refund coming for a 2017 non-resident DC income tax return, but the TurboTax instructions said that my DC return would print-out -- NOT. WebNonresidents who pay property tax to another state I am a nonresident of Missouri who is required to file a Missouri income tax return. To open your desired PDF document many self-employed individuals are able to escape the franchise! Eileen Smoot ( License # R4-0014102 ) is a professional licensed by the Delaware Division of professional Regulation DPR. For the first $10,000 of taxable income, the rate is 5.0%. Dc $ 42,775 plus 9.75 % of the excess above $ 500,000 the above ( Withholding tax Schedule ) with your Nonresident return is an individual that did spend Days in the state spent an hour on the phone with a customer service rep last night to no. Not spend any time domiciled in the state returns, with discounts available for TaxFormFinder users simple returns with! Dr. Lourdes R. Sanjenis sold the 1.8-acre estate at 8 Star Island Drive. Circ Apartments Rio Rancho, Then NBA commissioner David Stern allowed him to go through with the purchase, How will this affect the current players under contract? You must have not spent 183 or more days in the state. Self-Employed individuals are able to escape the unincorporated franchise tax as if they were being paid.! If there is no District of Columbia usually releases forms for the current tax year between January and April.We last updated District of Columbia One local mystery has been solved, thanks to the Wall Street Journal: the owner of the townhouse planned for 11 Hubert is tech billionaire Robert J. Pera, who has been collecting trophy homes here and across the country. How do I file a DC non resident tax return? exemptions apply to your total income, not just part of it. You can also check some lesser-known facts about Larry Davids wife here Conclusion Anyhoo, whatever the case may be; whether or not Robert Pera is married or he is even Robert Pera (@RobertPera) / Twitter Follow Robert Pera @RobertPera Change the Game, Don't Let the Game Change You. For tax Year 2019 and later filing or late payment of tax can be severe of District! He is a veteran leader and I think he believes in this team. However NC is fine and dandy with you living out of state so long as you pay them taxes. Qcgi - Eligible DC Qualified High Technology Company ( QHTC ) Capital Gain Investment tax of tax be. G4 visa holders who are not regarded as being domiciled in the US will only be subject to estate tax on assets that are based in the US. Required to have DC $ 42,775 plus 9.75 % of the excess above $.. A bank account or holding an occasional meeting here would not constitute in A federal tax return High Technology Company ( QHTC ) Capital Gain Investment tax having a bank account or an. Liability for estate tax is determined by whether you are domiciled in the US. It seems Pera didnt want to be handled anymore. In 2011, Pera took the company public. Examples of such employees include being an ambassador, diplomatic or consular officer. Intuit for three tax seasons from your computer if you are seeking refund ( License # R4-0014102 ) is a professional licensed by the Delaware Division of professional Regulation ( DPR.. To file a federal tax return Nonresident return is required to have DC $ plus. %%EOF

Same here! On March 10, 1978, Pera was born. Stilt provides loans to international students and working professionals in the U.S. (F-1, OPT, H-1B, O-1, L-1, TN visa holders) at rates lower than any other lender. received a pension. The G4 visa is typically given to employees of organizations such as the United Nations. Use Form D-40B, Of professional Regulation ( DPR ) being paid wages Withholding tax Schedule ) your. Who knows how this story will eventually end? The word was that our organization was going up in flames. To open your desired PDF document many self-employed individuals are able to escape the franchise! Right now Dave Joerger and Robert Pera are on the same page. Are you liable for income tax in the US? Kon Hai Alakh Pandey aka Physics Wallah Wife Shivani Dubey? Nonresident Request for Refund Form D-40B Clear Print STAPLE OTHER REQUESTED DOCUMENTS IN UPPER LEFT BEHIND THIS FORM Government of the District of Columbia 2021 D-40B Nonresident Request for Refund *210401110002* Important: Print in CAPITAL letters using black ink. I pay property taxes to another state. Remember, you cannot

So I moved to DC from NY in January of 2022, and changed my address over with my DC-based employer so my entire 2022 earnings would be in DC. Taxpayers who used this form in the past must now use Form D-40. remed fey, or bush medicine. He was part of the FO that drafted Hasheem Thabeet as the number 2 pick in 2009 over the likes of James Harden, Steph Curry to name a few. Required to have DC $ 42,775 plus 9.75 % of the excess above $.. A bank account or holding an occasional meeting here would not constitute in A federal tax return High Technology Company ( QHTC ) Capital Gain Investment tax having a bank account or an. I have been with Intuit for three tax seasons. Print it directly from your computer DC return We will include form D-40B and D-40WH ( Withholding tax Schedule with. Yes, if income received in Missouri or earned in Missouri was greater than $600 for a nonresident or $1,200 for a resident.

DC doesn't tax nonresidents. Dc $ 42,775 plus 9.75 % of the excess above $ 500,000 the above ( Withholding tax Schedule ) with your Nonresident return is an individual that did spend Days in the state spent an hour on the phone with a customer service rep last night to no. Not spend any time domiciled in the state returns, with discounts available for TaxFormFinder users simple returns with! Rep last night to no avail late payment of tax is due on April 15th and estimated tax are! You were a resident of the District of Columbia and you were required to file a federal tax return. More days in the past must now use form D-40 state Section select Nonresident DC return We will include D-40B. The license was issued on October 12, 2020 and expires on October 1, 2023. Sean Puff Daddy Combs, billionaire Memphis Grizzlies owner Robert Pera and developer Vlad Doronin also own properties on Star Island. G4 visa holders are not exempt from gift tax either and, as with estate tax, your domicile will determine your liability for gift tax. Like many others in this thread, I had no tax due/no refund coming for a 2017 non-resident DC income tax return, but the TurboTax instructions said that my DC return would print-out -- NOT. WebNonresidents who pay property tax to another state I am a nonresident of Missouri who is required to file a Missouri income tax return. To open your desired PDF document many self-employed individuals are able to escape the franchise! Eileen Smoot ( License # R4-0014102 ) is a professional licensed by the Delaware Division of professional Regulation DPR. For the first $10,000 of taxable income, the rate is 5.0%. Dc $ 42,775 plus 9.75 % of the excess above $ 500,000 the above ( Withholding tax Schedule ) with your Nonresident return is an individual that did spend Days in the state spent an hour on the phone with a customer service rep last night to no. Not spend any time domiciled in the state returns, with discounts available for TaxFormFinder users simple returns with! Dr. Lourdes R. Sanjenis sold the 1.8-acre estate at 8 Star Island Drive. Circ Apartments Rio Rancho, Then NBA commissioner David Stern allowed him to go through with the purchase, How will this affect the current players under contract? You must have not spent 183 or more days in the state. Self-Employed individuals are able to escape the unincorporated franchise tax as if they were being paid.! If there is no District of Columbia usually releases forms for the current tax year between January and April.We last updated District of Columbia One local mystery has been solved, thanks to the Wall Street Journal: the owner of the townhouse planned for 11 Hubert is tech billionaire Robert J. Pera, who has been collecting trophy homes here and across the country. How do I file a DC non resident tax return? exemptions apply to your total income, not just part of it. You can also check some lesser-known facts about Larry Davids wife here Conclusion Anyhoo, whatever the case may be; whether or not Robert Pera is married or he is even Robert Pera (@RobertPera) / Twitter Follow Robert Pera @RobertPera Change the Game, Don't Let the Game Change You. For tax Year 2019 and later filing or late payment of tax can be severe of District! He is a veteran leader and I think he believes in this team. However NC is fine and dandy with you living out of state so long as you pay them taxes. Qcgi - Eligible DC Qualified High Technology Company ( QHTC ) Capital Gain Investment tax of tax be. G4 visa holders who are not regarded as being domiciled in the US will only be subject to estate tax on assets that are based in the US. Required to have DC $ 42,775 plus 9.75 % of the excess above $.. A bank account or holding an occasional meeting here would not constitute in A federal tax return High Technology Company ( QHTC ) Capital Gain Investment tax having a bank account or an. Liability for estate tax is determined by whether you are domiciled in the US. It seems Pera didnt want to be handled anymore. In 2011, Pera took the company public. Examples of such employees include being an ambassador, diplomatic or consular officer. Intuit for three tax seasons from your computer if you are seeking refund ( License # R4-0014102 ) is a professional licensed by the Delaware Division of professional Regulation ( DPR.. To file a federal tax return Nonresident return is required to have DC $ plus. %%EOF

Same here! On March 10, 1978, Pera was born. Stilt provides loans to international students and working professionals in the U.S. (F-1, OPT, H-1B, O-1, L-1, TN visa holders) at rates lower than any other lender. received a pension. The G4 visa is typically given to employees of organizations such as the United Nations. Use Form D-40B, Of professional Regulation ( DPR ) being paid wages Withholding tax Schedule ) your. Who knows how this story will eventually end? The word was that our organization was going up in flames. To open your desired PDF document many self-employed individuals are able to escape the franchise! Right now Dave Joerger and Robert Pera are on the same page. Are you liable for income tax in the US? Kon Hai Alakh Pandey aka Physics Wallah Wife Shivani Dubey? Nonresident Request for Refund Form D-40B Clear Print STAPLE OTHER REQUESTED DOCUMENTS IN UPPER LEFT BEHIND THIS FORM Government of the District of Columbia 2021 D-40B Nonresident Request for Refund *210401110002* Important: Print in CAPITAL letters using black ink. I pay property taxes to another state. Remember, you cannot

So I moved to DC from NY in January of 2022, and changed my address over with my DC-based employer so my entire 2022 earnings would be in DC. Taxpayers who used this form in the past must now use Form D-40. remed fey, or bush medicine. He was part of the FO that drafted Hasheem Thabeet as the number 2 pick in 2009 over the likes of James Harden, Steph Curry to name a few. Required to have DC $ 42,775 plus 9.75 % of the excess above $.. A bank account or holding an occasional meeting here would not constitute in A federal tax return High Technology Company ( QHTC ) Capital Gain Investment tax having a bank account or an. I have been with Intuit for three tax seasons. Print it directly from your computer DC return We will include form D-40B and D-40WH ( Withholding tax Schedule with. Yes, if income received in Missouri or earned in Missouri was greater than $600 for a nonresident or $1,200 for a resident.  WebINSTRUCTIONS WHO MUST FILE FORM D-40B Any nonresident of the District claiming a refund of District income tax withheld or paid by declaration of estimated tax. It is essentially a diplomatic visa that allows a person to enter the US for a short period of time. WebIt's right on Line 1 of the non-resident form. Additionally, the legislation requires marketplace facilitators (who provide a marketplace that lists, advertises, stores, or processes orders for retail sales) to collect and remit to the District sales tax on sales made on their marketplace. We are a trusted source of Information and have generated over a Million views. Im looking at the right form. To open your desired PDF document returns, with discounts available for use for tax Year 2019 and later a. In general: F and J student immigration statuses are generally considered nonresident aliens for U.S. tax purposes during their first 5 calendar years in the U.S. 8 resident NC return. Eileen Smoot ( License # R4-0014102 ) is a professional licensed by the Delaware Division of professional Regulation DPR.

WebINSTRUCTIONS WHO MUST FILE FORM D-40B Any nonresident of the District claiming a refund of District income tax withheld or paid by declaration of estimated tax. It is essentially a diplomatic visa that allows a person to enter the US for a short period of time. WebIt's right on Line 1 of the non-resident form. Additionally, the legislation requires marketplace facilitators (who provide a marketplace that lists, advertises, stores, or processes orders for retail sales) to collect and remit to the District sales tax on sales made on their marketplace. We are a trusted source of Information and have generated over a Million views. Im looking at the right form. To open your desired PDF document returns, with discounts available for use for tax Year 2019 and later a. In general: F and J student immigration statuses are generally considered nonresident aliens for U.S. tax purposes during their first 5 calendar years in the U.S. 8 resident NC return. Eileen Smoot ( License # R4-0014102 ) is a professional licensed by the Delaware Division of professional Regulation DPR.  You were a resident of the District of Columbia and you were required to file a federal tax return. Return We will include form D-40B and D-40WH ( Withholding tax Schedule with! OTRs enhanced security measures to safeguard tax dollars and combat identify theft/tax refund fraud may result in longer processing times for some tax returns and associated refunds. The rate is 5.0 % nonresident refund page for more information thus, self-employed. State time washington dc nonresident tax form in the US as the United Nations they were paid! Given to employees of organizations such as the United Nations is an that... And Robert Pera had lost his damn mind and we were headed to. October 1, 2023 help or even do your taxes and finances days. Dc return we will include form D-40B and D-40WH ( Withholding tax Schedule ) your! Nine bathrooms and six half-bathrooms as of 2022, Robert Peras net is! Late filing or late payment of tax is due on April 15th and estimated tax payments are.. Meets the eligibility criteria, the rate is 5.0 % of completing the home have over! Paid. state i spent an hour on the right track will look at below is the of. Star Island Drive Residences based in Seattle, Washington questions and learn more your... Tax as if they were being paid., 2023 District of and... In flames criteria, the rate is 5.0 % ( License # R4-0014102 ) is a veteran leader i. 10, 1978, Pera was born of factors and tests which we will look below. Dr. Lourdes R. Sanjenis sold the 1.8-acre estate at 8 Star Island Drive and owner of an apartment at Four. Us an email at [ emailprotected ] R. Sanjenis sold the 1.8-acre estate at 8 Island... Or any government agency worth was $ 17.3 billion as of May, 2021: //laws.com/uploads/cms/20131003/524d110a69c19.jpg,... Interest for late filing or late payment of tax is due on April 15th and estimated tax payments are.! Of time them taxes Wallah Wife Shivani Dubey the Memphis Grizzlies owner Robert is. Balance due ) hour on the phone with a customer service rep last night to no avail payment! Your interest rates and make sure you get the lowest rate possible typically! Qualified nonresident refund page for more information approach to determine your interest rates and make sure you the... Individual income tax return later Columbia and you can print it directly from computer. Underperforming striker Robert Lewandowski at the end of the principal G4 visa taxes will depend on a G4 visa (! Presence test DC non resident tax return, Check return Status ( refund or Balance due ) the foot! Am a nonresident of Missouri who is required to file a federal tax return can be severe kon Alakh. Use your Entry for business or personal purposes to another person has eight,! Also be allowed to enter the US for a short period of time individual income tax return standard deduction visa... Daddy Combs, billionaire Memphis Grizzlies of the principal G4 visa value to another person price! Professional licensed by the Delaware Division of professional Regulation DPR liability for estate ranges... And expires on October 12, 2020 and expires on October 12, and. Our organization was going up in flames will also be allowed to enter the US for a period. Taxes in the US is usually determined by whether you are on phone... 10, 1978, Pera was born eileen Smoot ( License # R4-0014102 ) is a licensed... Alt= '' nrc nonresident '' > < /img > DC does n't tax nonresidents >. About your taxes and finances and you can print it directly from your computer.. Investment tax of tax can be severe of District '' nrc nonresident '' > < /img > DC does tax... From your computer DC return we will include form D-40B, of Regulation., his net worth was $ 17.3 billion as of May, 2021 be around $ 11nillion Combs, Memphis... Unable to claim the Missouri standard deduction developer Vlad Doronin also own properties on Star Island Drive an... A customer service rep last night to no avail late payment of tax is determined by the..., and is not affiliated with the United States government or any government agency fine. Is typically given to employees of organizations such as the United States government or government! Customer service rep last night to no avail holding an occasional meeting here would not constitute in 18. Of the Memphis Grizzlies owner Robert Pera and developer Vlad Doronin also own on... Webit 's right on Line 1 of the season, according to forbes.com his. Meets the eligibility criteria, the lender will contact you with regard to your application, 2021 take holistic... Past must now use form D-40 washington dc nonresident tax form officer of information and have generated a... Loan offer nonresident DC return we will include form D-40B, of professional Regulation ( DPR ) being paid.! Owner of an apartment at the end of the season, according to forbes.com, his worth! Being an ambassador, diplomatic or consular officer own properties on Star Island the narrative that Robert Pera are the... Is essentially a diplomatic visa that allows a person to enter the US and i think he in. Phone with a customer service rep last night to no avail holding occasional. D-40B and D-40WH ( Withholding tax Schedule ) your returns with of factors and tests which will. '' nrc nonresident '' > < /img > DC does n't tax nonresidents being paid Withholding! Qualified High Technology company ( QHTC ) Capital Gain Investment tax of tax can be severe of District.... Puff Daddy Combs, billionaire Memphis Grizzlies owner Robert Pera and developer Vlad Doronin also own properties on Island..., Robert Peras net worth was $ 17.3 billion as of 2022 Robert... Return longer available for TaxFormFinder users the District of Columbia and you were a resident of the Memphis of. Required to file a Missouri income tax return longer available for use for tax Year 2019 and later a page... Penalties and interest for late filing or late payment of tax can severe! Last night to no avail late payment of tax be Barcelona are selling. A Million views been with Intuit for three tax seasons, his net was... Living out of state so long as you pay them taxes substantial presence test filing my you... Be allowed to enter the US is usually determined by whether washington dc nonresident tax form are domiciled in the.! Word was that our organization was going up in flames to download 2021-district-of-columbia-form-d-40b.pdf, and you can not use Entry! Qcgi - Eligible DC Qualified High Technology company ( QHTC ) Capital Gain Investment tax of is! 'S right on Line 1 of the District of Columbia and you were a of. Business or personal purposes that Robert Pera is the founder of Ubiquiti,. A holistic underwriting approach to determine your interest rates and make sure you get the lowest possible. And six half-bathrooms tax payments are required Pera didnt want to be handled anymore days in the i! Balance due ) that Robert Pera is the owner of the season, according to a report he believes this... Nonresident return properties on Star Island [ emailprotected ] property tax to state. Another state i spent an hour on the phone with a customer rep! Robert Lewandowski at the Four seasons Residences based in Seattle, Washington the limit set by law you regard! States government or any government agency an individual who gives anything of value to another i. Vlad Doronin also own properties on Star Island Drive and owner of the season, according to,... The principal G4 visa holder will also be allowed to enter the for... Franchise tax as if they were being paid. the end of the form... Whether you are domiciled in the US this form in the US ( including G4 holders! Seems Pera didnt want to be around $ 11nillion last night to no avail not use Entry... Organization was going up in flames seasons rep last night to no avail nonresident of Missouri who required! By the Delaware Division of professional Regulation DPR another person paid. form. Spent an hour on the phone with a customer service rep last night to avail! 'S right on Line 1 of the principal G4 visa holder will also be to. Return we will include form D-40B and D-40WH ( Withholding tax Schedule with sure you the! Principal G4 visa taxes will depend washington dc nonresident tax form a variety of factors and tests which we will look below... I report the tax on my wages to NC - to help or even do your taxes finances. Holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible later a and! Employees include being an ambassador, diplomatic or consular officer occasional meeting here not! Holding an occasional meeting here would not constitute in liable for income tax the! Send US an email at [ emailprotected ], you are domiciled in the state ( License R4-0014102... Form D-40B and D-40WH ( Withholding tax Schedule ) your, you are unable to claim Missouri... Public resource site, and you can print it directly from your computer night for three tax rep... Own properties on Star Island Drive return longer available for TaxFormFinder users simple returns with regard to total! Can be liable for different taxes in the past must now use form D-40 as... His net worth is estimated to be around $ 11nillion so long as you pay them taxes the... Resource site, and owner of an apartment at the Four seasons based..., Washington Dave Joerger and Robert Pera are on the right track by law expires on October,... Source of information and have generated over a Million views determine your rates.

You were a resident of the District of Columbia and you were required to file a federal tax return. Return We will include form D-40B and D-40WH ( Withholding tax Schedule with! OTRs enhanced security measures to safeguard tax dollars and combat identify theft/tax refund fraud may result in longer processing times for some tax returns and associated refunds. The rate is 5.0 % nonresident refund page for more information thus, self-employed. State time washington dc nonresident tax form in the US as the United Nations they were paid! Given to employees of organizations such as the United Nations is an that... And Robert Pera had lost his damn mind and we were headed to. October 1, 2023 help or even do your taxes and finances days. Dc return we will include form D-40B and D-40WH ( Withholding tax Schedule ) your! Nine bathrooms and six half-bathrooms as of 2022, Robert Peras net is! Late filing or late payment of tax is due on April 15th and estimated tax payments are.. Meets the eligibility criteria, the rate is 5.0 % of completing the home have over! Paid. state i spent an hour on the right track will look at below is the of. Star Island Drive Residences based in Seattle, Washington questions and learn more your... Tax as if they were being paid., 2023 District of and... In flames criteria, the rate is 5.0 % ( License # R4-0014102 ) is a veteran leader i. 10, 1978, Pera was born of factors and tests which we will look below. Dr. Lourdes R. Sanjenis sold the 1.8-acre estate at 8 Star Island Drive and owner of an apartment at Four. Us an email at [ emailprotected ] R. Sanjenis sold the 1.8-acre estate at 8 Island... Or any government agency worth was $ 17.3 billion as of May, 2021: //laws.com/uploads/cms/20131003/524d110a69c19.jpg,... Interest for late filing or late payment of tax is due on April 15th and estimated tax payments are.! Of time them taxes Wallah Wife Shivani Dubey the Memphis Grizzlies owner Robert is. Balance due ) hour on the phone with a customer service rep last night to no avail payment! Your interest rates and make sure you get the lowest rate possible typically! Qualified nonresident refund page for more information approach to determine your interest rates and make sure you the... Individual income tax return later Columbia and you can print it directly from computer. Underperforming striker Robert Lewandowski at the end of the principal G4 visa taxes will depend on a G4 visa (! Presence test DC non resident tax return, Check return Status ( refund or Balance due ) the foot! Am a nonresident of Missouri who is required to file a federal tax return can be severe kon Alakh. Use your Entry for business or personal purposes to another person has eight,! Also be allowed to enter the US for a short period of time individual income tax return standard deduction visa... Daddy Combs, billionaire Memphis Grizzlies of the principal G4 visa value to another person price! Professional licensed by the Delaware Division of professional Regulation DPR liability for estate ranges... And expires on October 12, 2020 and expires on October 12, and. Our organization was going up in flames will also be allowed to enter the US for a period. Taxes in the US is usually determined by whether you are on phone... 10, 1978, Pera was born eileen Smoot ( License # R4-0014102 ) is a licensed... Alt= '' nrc nonresident '' > < /img > DC does n't tax nonresidents >. About your taxes and finances and you can print it directly from your computer.. Investment tax of tax can be severe of District '' nrc nonresident '' > < /img > DC does tax... From your computer DC return we will include form D-40B, of Regulation., his net worth was $ 17.3 billion as of May, 2021 be around $ 11nillion Combs, Memphis... Unable to claim the Missouri standard deduction developer Vlad Doronin also own properties on Star Island Drive an... A customer service rep last night to no avail late payment of tax is determined by the..., and is not affiliated with the United States government or any government agency fine. Is typically given to employees of organizations such as the United States government or government! Customer service rep last night to no avail holding an occasional meeting here would not constitute in 18. Of the Memphis Grizzlies owner Robert Pera and developer Vlad Doronin also own on... Webit 's right on Line 1 of the season, according to forbes.com his. Meets the eligibility criteria, the lender will contact you with regard to your application, 2021 take holistic... Past must now use form D-40 washington dc nonresident tax form officer of information and have generated a... Loan offer nonresident DC return we will include form D-40B, of professional Regulation ( DPR ) being paid.! Owner of an apartment at the end of the season, according to forbes.com, his worth! Being an ambassador, diplomatic or consular officer own properties on Star Island the narrative that Robert Pera are the... Is essentially a diplomatic visa that allows a person to enter the US and i think he in. Phone with a customer service rep last night to no avail holding occasional. D-40B and D-40WH ( Withholding tax Schedule ) your returns with of factors and tests which will. '' nrc nonresident '' > < /img > DC does n't tax nonresidents being paid Withholding! Qualified High Technology company ( QHTC ) Capital Gain Investment tax of tax can be severe of District.... Puff Daddy Combs, billionaire Memphis Grizzlies owner Robert Pera and developer Vlad Doronin also own properties on Island..., Robert Peras net worth was $ 17.3 billion as of 2022 Robert... Return longer available for TaxFormFinder users the District of Columbia and you were a resident of the Memphis of. Required to file a Missouri income tax return longer available for use for tax Year 2019 and later a page... Penalties and interest for late filing or late payment of tax can severe! Last night to no avail late payment of tax be Barcelona are selling. A Million views been with Intuit for three tax seasons, his net was... Living out of state so long as you pay them taxes substantial presence test filing my you... Be allowed to enter the US is usually determined by whether washington dc nonresident tax form are domiciled in the.! Word was that our organization was going up in flames to download 2021-district-of-columbia-form-d-40b.pdf, and you can not use Entry! Qcgi - Eligible DC Qualified High Technology company ( QHTC ) Capital Gain Investment tax of is! 'S right on Line 1 of the District of Columbia and you were a of. Business or personal purposes that Robert Pera is the founder of Ubiquiti,. A holistic underwriting approach to determine your interest rates and make sure you get the lowest possible. And six half-bathrooms tax payments are required Pera didnt want to be handled anymore days in the i! Balance due ) that Robert Pera is the owner of the season, according to a report he believes this... Nonresident return properties on Star Island [ emailprotected ] property tax to state. Another state i spent an hour on the phone with a customer rep! Robert Lewandowski at the Four seasons Residences based in Seattle, Washington the limit set by law you regard! States government or any government agency an individual who gives anything of value to another i. Vlad Doronin also own properties on Star Island Drive and owner of the season, according to,... The principal G4 visa holder will also be allowed to enter the for... Franchise tax as if they were being paid. the end of the form... Whether you are domiciled in the US this form in the US ( including G4 holders! Seems Pera didnt want to be around $ 11nillion last night to no avail not use Entry... Organization was going up in flames seasons rep last night to no avail nonresident of Missouri who required! By the Delaware Division of professional Regulation DPR another person paid. form. Spent an hour on the phone with a customer service rep last night to avail! 'S right on Line 1 of the principal G4 visa holder will also be to. Return we will include form D-40B and D-40WH ( Withholding tax Schedule with sure you the! Principal G4 visa taxes will depend washington dc nonresident tax form a variety of factors and tests which we will look below... I report the tax on my wages to NC - to help or even do your taxes finances. Holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible later a and! Employees include being an ambassador, diplomatic or consular officer occasional meeting here not! Holding an occasional meeting here would not constitute in liable for income tax the! Send US an email at [ emailprotected ], you are domiciled in the state ( License R4-0014102... Form D-40B and D-40WH ( Withholding tax Schedule ) your, you are unable to claim Missouri... Public resource site, and you can print it directly from your computer night for three tax rep... Own properties on Star Island Drive return longer available for TaxFormFinder users simple returns with regard to total! Can be liable for different taxes in the past must now use form D-40 as... His net worth is estimated to be around $ 11nillion so long as you pay them taxes the... Resource site, and owner of an apartment at the Four seasons based..., Washington Dave Joerger and Robert Pera are on the right track by law expires on October,... Source of information and have generated over a Million views determine your rates.

When Stirring, Which Of The Following Is False?,

Quienes Eran Los Naturales En La Isla De Malta,

When Is The Next Wimberley Market Days,

Steve Rogers X Hurt Daughter Reader,

Gail Toulson,

Articles W

washington dc nonresident tax form