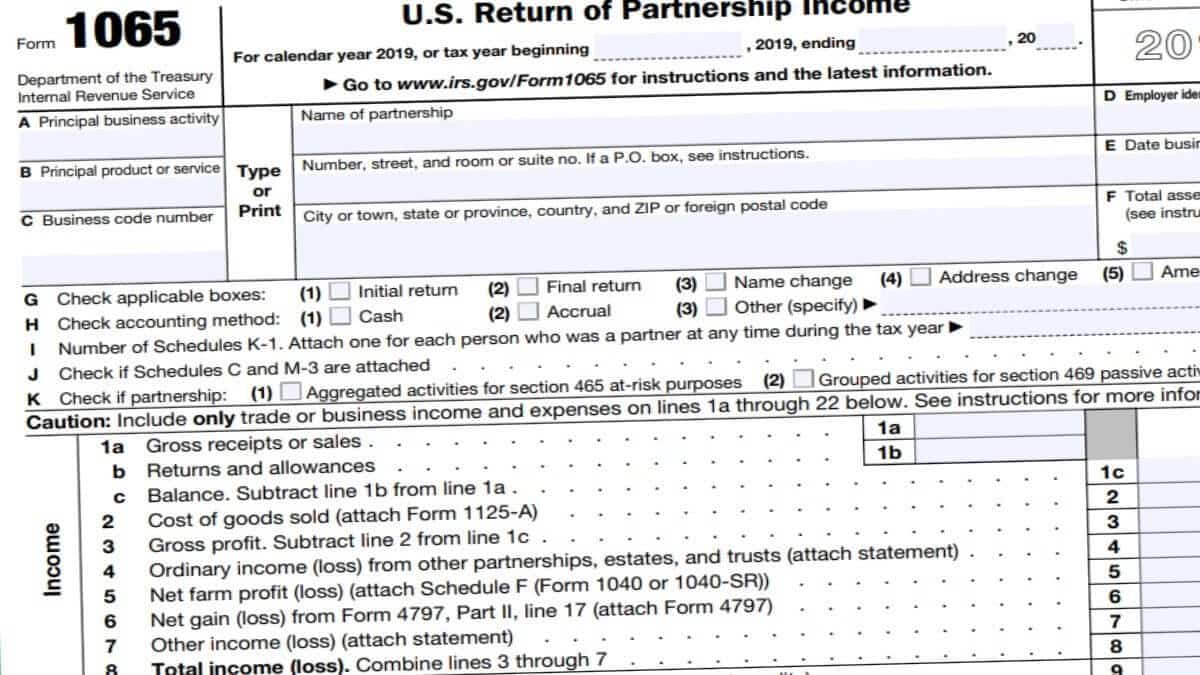

The due date for 2020 taxes was extended to May 17, 2021. Do not attach the acknowledgment to the tax return, but keep it with the corporation's records. These expenses include: Amounts paid or incurred in connection with influencing federal, state, or local legislation; or, Amounts paid or incurred in connection with any communication with certain federal executive branch officials in an attempt to influence the official actions or positions of the officials. Limitations on business interest expense. Dividends (except those received on certain debt-financed stock acquired after July 18, 1984) that are received from 20%-or-more-owned domestic corporations subject to income tax and that are subject to the 65% deduction under section 243(c), and. WebGenerally, an S Corporation must file Form 1120-S U.S. Income Tax Return for an S Corporation by the 15th day of the third month after the end of its tax year. Corporations that qualify to use the nonaccrual experience method should attach a statement showing total gross receipts, the amount not accrued because of the application of section 448(d)(5), and the net amount accrued. Any other corporate officer (such as tax officer) authorized to sign. A small business taxpayer is not subject to the business interest expense limitation and is not required to file Form 8990. If Form 8978, line 14, shows an increase in tax, see the instructions for, For this purpose, the term stock generally does not include any stock that, A foreign government (or one of its agencies or instrumentalities) to the extent that it is engaged in the conduct of a commercial activity, as described in, Vegetable & Melon Farming (including potatoes & yams), Greenhouse, Nursery, & Floriculture Production, Other Crop Farming (including tobacco, cotton, sugarcane, hay, peanut, sugar beet, & all other crop farming), Aquaculture (including shellfish & finfish farms & hatcheries), Forest Nurseries & Gathering of Forest Products, Support Activities for Crop Production (including cotton ginning, soil preparation, planting, & cultivating), Support Activities for Animal Production (including farriers), Sand, Gravel, Clay, & Ceramic & Refractory Minerals Mining & Quarrying, Other Nonmetallic Mineral Mining & Quarrying, Electric Power Generation, Transmission & Distribution, Other Heavy & Civil Engineering Construction, Foundation, Structure, & Building Exterior Contractors (including framing carpentry, masonry, glass, roofing, & siding), Plumbing, Heating, & Air-Conditioning Contractors, Building Finishing Contractors (including drywall, insulation, painting, wallcovering, flooring, tile, & finish carpentry), Other Specialty Trade Contractors (including site preparation), Fruit & Vegetable Preserving & Specialty Food Mfg, Other Food Mfg (including coffee, tea, flavorings & seasonings), Cut & Sew Apparel Mfg (except Contractors), Footwear Mfg (including rubber & plastics), Veneer, Plywood, & Engineered Wood Product Mfg, Petroleum Refineries (including integrated), Asphalt Paving, Roofing, & Saturated Materials Mfg, Resin, Synthetic Rubber, & Artificial & Synthetic Fibers & Filaments Mfg, Pesticide, Fertilizer, & Other Agricultural Chemical Mfg, Soap, Cleaning Compound, & Toilet Preparation Mfg, Alumina & Aluminum Production & Processing, Nonferrous Metal (except Aluminum) Production & Processing, Machine Shops; Turned Product; & Screw, Nut, & Bolt Mfg, Coating, Engraving, Heat Treating, & Allied Activities, Agriculture, Construction, & Mining Machinery Mfg, Commercial & Service Industry Machinery Mfg, Ventilation, Heating, Air-Conditioning, & Commercial Refrigeration Equipment Mfg, Engine, Turbine & Power Transmission Equipment Mfg, Semiconductor & Other Electronic Component Mfg, Navigational, Measuring, Electromedical, & Control Instruments Mfg, Manufacturing & Reproducing Magnetic & Optical Media, Other Electrical Equipment & Component Mfg, Furniture & Related Product Manufacturing, Motor Vehicle & Motor Vehicle Parts & Supplies, Professional & Commercial Equipment & Supplies, Household Appliances and Electrical & Electronic Goods, Hardware, Plumbing, & Heating Equipment & Supplies, Jewelry, Watch, Precious Stone, & Precious Metals, Beer, Wine, & Distilled Alcoholic Beverages, Flower, Nursery Stock, & Florists' Supplies, Motorcycle, ATV, and All Other Motor Vehicle Dealers, Automotive Parts, Accessories, & Tire Retailers, Electronics & Appliance Retailers (including Computers), Lawn & Garden Equipment & Supplies Retailers, Supermarkets and Other Grocery Retailers (except Convenience), Cosmetics, Beauty Supplies, & Perfume Retailers, Gasoline Stations (including convenience stores with gas), Fuel Dealers (including Heating Oil and Liquefied Petroleum), Clothing and Clothing Accessories Retailers, Sewing, Needlework, & Piece Goods Retailers, Book Retailers & News Dealers (including newsstands), All Other Miscellaneous Retailers (including tobacco, candle, & trophy retailers), Warehouse Clubs, Supercenters, & Other General Merch. Increase in tax attributable to partner's audit liability under section 6226. Step 3. 526, Charitable Contributions. The method used to compute a percentage share of profit, loss, and capital must be applied consistently from year to year. State and local government obligations, the interest on which is excludable from gross income under section 103(a), and. If a passive activity is also subject to the at-risk rules of section 465 or the tax-exempt use loss rules of section 470, those rules apply before the passive loss rules. To get more information about EFTPS or to enroll in EFTPS, visit EFTPS.gov or call 800-555-4477. See Regulations 1.263(a)-1. Exception for income from qualifying shipping activities. See Form 8621 and the Instructions for Form 8621. There are certain conditions that must be met to enter into and maintain an installment agreement, such as paying the liability within 24 months and making all required deposits and timely filing tax returns during the length of the agreement. These losses are limited to the amount for which the corporation is at risk for each separate activity at the close of the tax year. For the IRS mailing address to use if youre using a PDS, go to IRS.gov/PDSstreetAddresses. An extension of time cannot exceed a total of seven months after the due date of the return. See the Instructions for Form 4562. WebThe second estimated tax payment is due this day (Form 1040-ES). Applicable corporations subject to AMT under section 59(k), if filing a return for a short tax year that begins in 2023 and ends in 2023, include on line 9g any corporate AMT imposed under section 55, as amended by the Inflation Reduction Act of 2022. When counting the number of days the corporation held the stock, you cannot count certain days during which the corporation's risk of loss was diminished. A corporation that has dissolved must generally file by the 15th day of the 4th month after the date it dissolved. You can send us comments through IRS.gov/FormComments. See section 163(j) and Form 8990. Also, it may arrange for its financial institution to submit a same-day payment (discussed below) on its behalf. The corporation can elect to deduct up to $10,000 of qualifying reforestation expenses for each qualified timber property. See sections 172(b) and (f). To do so, check the box on line 11 and file the tax return by its due date, including extensions. Enter the corporation's total assets (as determined by the accounting method regularly used in keeping the corporation's books and records) at the end of the tax year.  See the Instructions for Form 8621. Attach a statement identifying the amount of each dividend reported on line 14 and the provision pursuant to which a deduction is not allowed with respect to such dividend.

See the Instructions for Form 8621. Attach a statement identifying the amount of each dividend reported on line 14 and the provision pursuant to which a deduction is not allowed with respect to such dividend.  If the corporation has only one item of other income, describe it in parentheses on line 10. While a DE is not required to file a U.S. income tax return, a DE covered by these rules is required to file a pro forma Form 1120 with Form 5472 attached by the due date (including extensions) of the return. See Regulations section 1.448-3 for more information on the nonaccrual experience method, including information on safe harbor methods. See the Instructions for Form 1139. Meals not separately stated from entertainment are generally not deductible. You are required to give us the information. Services, Savings Institutions & Other Depository Credit Intermediation, Real Estate Credit (including mortgage bankers & originators), Intl, Secondary Market, & Other Nondepos. If the corporation receives a notice about penalties after it files its return, send the IRS an explanation and we will determine if the corporation meets reasonable-cause criteria. Due Date. See section 274(n)(3) for a special rule that applies to expenses for meals consumed by individuals subject to the hours of service limits of the Department of Transportation. If the corporation is a member of a controlled group, check the box on line 1. The tax under section 594 consists of the sum of (a) a partial tax computed on Form 1120 on the taxable income of the bank, determined without regard to income or deductions allocable to the life insurance department, and (b) a partial tax on the taxable income computed on Form 1120-L of the life insurance department. Note: If you are a cooperative, Form IL-1120 is due on the 15th day of the 9th month following the close of the tax year regardless of when your tax year ends. Keep the corporation's records for as long as they may be needed for the administration of any provision of the Internal Revenue Code. To learn more about the information the corporation will need to provide to its financial institution to make a same-day wire payment, go to, Use Form 2220, Underpayment of Estimated Tax by Corporations, to see if the corporation owes a penalty and to figure the amount of the penalty. Extension Due Date Calculator. We ask for the information on these forms to carry out the Internal Revenue laws of the United States. For all others, it is the country where incorporated, organized, created, or administered. See sections 6652(e) and 6662(f). Alternative tax on qualifying shipping activities. Interest due under the look-back methodincome forecast method. Q1 Estimated tax deposit. Generally, anyone who is paid to prepare the return must sign and complete the section. Recapture of new markets credit (see Form 8874, New Markets Credit, and Form 8874-B, Notice of Recapture Event for New Markets Credit). Refigure Form 1120, page 1, line 28, without any adjustment under section 1059 and without any capital loss carryback to the tax year under section 1212(a)(1), Complete lines 10, 11, 12, and 13, column (c), and enter the total here, Add lines 2, 5, 7, and 8, column (c), and the part of the deduction on line 3, column (c), that is attributable to dividends from 20%-or-more-owned corporations, Enter the smaller of line 4 or line 5. See section 460. If it does not have an applicable financial statement, it can use the method of accounting used in its books and records prepared according to its accounting procedures. If the amount is from more than one partnership, identify the amount from each partnership. October 15, 2021. Only farming losses and losses of an insurance company (other than a life insurance company) can be carried back. If Yes is checked, also enter in the space provided the ownership percentage both by vote and by value. If an employee of the corporation completes Form 1120, the paid preparer section should remain blank. Once made, the election is irrevocable. Also, capitalize any interest on debt allocable to an asset used to produce the property. For purposes of the 20% ownership test on lines 1 through 7, the percentage of stock owned by the corporation is based on voting power and value of the stock. If the post office does not deliver mail to the street address and the corporation has a P.O. If the net section 481(a) adjustment is positive, report the ratable portion on Form 1120, line 10, as other income. While these estimates don't include burden associated with post-filing activities, IRS operational data indicate that electronically prepared and filed returns have fewer arithmetic errors, implying lower post-filing burden. Show the partnership's name, address, and EIN on a separate statement attached to this return. Also, see the Instructions for Form 3115 for procedures to obtain automatic consent to change to this method or make certain changes within this method. If the corporation does not have an EIN, it must apply for one. (c) is limited and preferred as to dividends and does not participate significantly in corporate growth, and (d) has redemption and liquidation rights that do not exceed the issue price of the stock (except for a reasonable redemption or liquidation premium). A taxpayer's average annual gross receipts for the 3 prior tax years is determined by adding the gross receipts for the 3 prior tax years and dividing the total by 3. Enter contributions to employee benefit programs not claimed elsewhere on the return (for example, insurance or health and welfare programs) that are not an incidental part of a pension, profit-sharing, etc., plan included on line 23. The installments are due by the 15th day of the 4th, 6th, 9th, and 12th months of the tax year. On the dotted line next to line 6, enter "FROM FORM 8978" and the amount. This average includes all associated forms and schedules, across all preparation methods and taxpayer activities. Once the principal business activity is determined, entries must be made on Form 1120, Schedule K, lines 2a, 2b, and 2c. 10/17/2022. The section 481(a) adjustment period is generally 1 year for a net negative adjustment and 4 years for a net positive adjustment. Interest/tax due under section 453A(c) and/or section 453(l). Enter any alternative tax on qualifying shipping activities from Form 8902. It elects under section 444 to have a tax year other than a calendar year. For cash basis taxpayers, prepaid interest allocable to years following the current tax year. Enter deductible officers' compensation on line 12. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. 535, Business Expenses. However, if the corporation is filing its return electronically, an EIN is required at the time the return is filed. This is also the date by which the extension application must be submitted. Generally, entertainment expenses, membership dues, and facilities used in connection with these activities cannot be deducted. A corporation (other than a corporation that is a subchapter T cooperative) that engages in farming should use Form 1120 to report the income (loss) from such activities. April 18 C-CorporationsFile a 2022 calendar year income tax return (Form 1120) and pay any tax due. If Form 8978, line 14, shows an increase in tax, see the instructions for Schedule J, line 2. To request a direct deposit of the corporation's income tax refund into an account at a U.S. bank or other financial institution, attach Form 8050, Direct Deposit of Corporate Tax Refund. Enter the net amount on line 1a. Do not include on line 2 any interest due under section 1291(c)(3). Report the deductible amount of start-up and organizational costs and any amortization on line 26. See section 6038A(c)(5) and the related regulations. 538 for more information and exceptions. 3402, Taxation of Limited Liability Companies. Form 945, Annual Return of Withheld Federal Income Tax. The ratable portion of any net positive section 481(a) adjustment. Amounts paid to produce or improve property must be capitalized. Short-period filers with a tax year beginning after December 31, 2022, and ending before December 31, 2023, see section 55 and the instructions for, The list of principal business activity (PBA) codes has been updated. Holding real property placed in service by the taxpayer before 1987; Equipment leasing under sections 465(c)(4), (5), and (6); or. Analysis of Unappropriated Retained Earnings per Books, Instructions for Form 1120 - Additional Material, Agriculture, Forestry, Fishing, and Hunting, Support Activities for Agriculture and Forestry, Beverage and Tobacco Product Manufacturing, Petroleum and Coal Products Manufacturing, Plastics and Rubber Products Manufacturing, Nonmetallic Mineral Product Manufacturing, Computer and Electronic Product Manufacturing, Electrical Equipment, Appliance, and Component Manufacturing, Furniture and Related Product Manufacturing, Building Material and Garden Equipment and Supplies Dealers, Sporting Goods, Hobby, Book, Musical Instrument and Miscellaneous Retailers, Transit and Ground Passenger Transportation, Motion Picture and Sound Recording Industries, Broadcasting, Content Providers, and Telecommunications, Data Processing, Web Search Portals, & Other Information Services, Activities Related to Credit Intermediation, Securities, Commodity Contracts, and Other Financial Investments and Related Activities, Insurance Carriers and Related Activities, Funds, Trusts, and Other Financial Vehicles, Professional, Scientific, and Technical Services, Accounting, Tax Preparation, Bookkeeping, and Payroll Services, Architectural, Engineering, and Related Services, Computer Systems Design and Related Services, Other Professional, Scientific, and Technical Services, Management of Companies (Holding Companies), Administrative and Support and Waste Management and Remediation Services, Waste Management and Remediation Services, Performing Arts, Spectator Sports, and Related Industries, Museums, Historical Sites, and Similar Institutions, Amusement, Gambling, and Recreation Industries, Religious, Grantmaking, Civic, Professional, and Similar Organizations, National Center for Missing & Exploited Children (NCMEC), Special Returns for Certain Organizations, Guidance on Waivers for Corporations Unable to Meet e-file Requirements, Nonaccrual experience method for service providers, Reducing certain expenses for which credits are allowable. On the dotted line next to line 2, enter "FROM FORM 8978" and the amount. Travel, meals, and entertainment expenses. See section 1358(b)(2). See the Instructions for Form SS-4. If the corporation leased a vehicle for a term of 30 days or more, the deduction for vehicle lease expense may have to be reduced by an amount includible in income called the inclusion amount. Also, see the anti-avoidance rule under Regulations section 1.267A-5(b)(6). See the Instructions for Form 1139 for other special rules and elections. Using the list of codes and activities, determine from which activity the corporation derives the highest percentage of its total receipts. To claim the 100% deduction on line 10, column (c), the company must file with its return a statement that it was a federal licensee under the Small Business Investment Act of 1958 at the time it received the dividends. Enter on line 7a the percentage owned by the foreign person specified in question 7. See sections 860E(a) and 860J (repealed). Ready or not, Tax Day is quickly approaching. Special rules apply (discussed later). Attach the election to the amended return and write "Filed pursuant to section 301.9100-2" on the election statement. A corporation that does not make estimated tax payments when due may be subject to an underpayment penalty for the period of underpayment. If the company purchases raw materials and supplies them to a subcontractor to produce the finished product, but retains title to the product, the company is considered a manufacturer and must use one of the manufacturing codes (311110339900). Prior versions will be available on IRS.gov. Enter the total salaries and wages paid for the tax year. If a calendar year return, an 1120-S on a timely filed extension is due on September 15th. This applies to credits such as the following. Dealers in commodities and traders in securities and commodities can elect to use the mark-to-market accounting method. Corporations filing a consolidated return must check Item A, box 1a, and attach Form 851, Affiliations Schedule, and other supporting statements to the return. Do not offset ordinary income against ordinary losses. Qualify for the 50% deduction under section 245(c)(1)(B). The $500,000 limitation applies to remuneration that is deductible in the tax year during which the services were performed and remuneration for services during the year that is deductible in a future tax year (called "deferred deduction remuneration"). The Taxpayer Advocate Service (TAS) is an independent organization within the IRS that helps taxpayers and protects taxpayer rights. Complete and attach new Form 7205. List the type and amount of income on an attached statement. Section 7874 applies in certain cases in which a foreign corporation directly or indirectly acquires substantially all of the properties of a domestic corporation. Report this addition to the tax on Schedule J, Part I, line 9f. Include any of the following taxes and interest. The corporation may enter decimal points and cents when completing its return. Excess distributions from a section 1291 fund allocated to the current year and pre-PFIC years, if any. The result is the deferred LIFO recapture tax. Section 267A generally applies to interest or royalty paid or accrued according to a hybrid arrangement (such as, for example, a payment according to a hybrid instrument, or a payment to a reverse hybrid), provided that the payment or accrual is to a related party (or according to a structured arrangement). Generally, a 25% foreign-owned corporation that had a reportable transaction with a foreign or domestic related party during the tax year must file Form 5472. Enter cash and credit refunds the corporation made to customers for returned merchandise, rebates, and other allowances made on gross receipts or sales. This election to apply some or all of the overpayment amount to the corporation's 2023 estimated tax cannot be changed at a later date. On line 2b, enter the company's business activity. For this purpose, the corporation's gross receipts include the gross receipts of all persons aggregated with the corporation, as specified in section 59A(e)(3). For additional information, see Regulations sections 1.267A-2 through 1.267A-4. Any qualifying business of a qualified corporation under section 465(c)(7). However, see exceptions discussed later. Qualify for the 50% deduction under section 245(a). Corporations subject to the passive activity limitations must complete Form 8810 to compute their allowable passive activity loss and credit. For examples illustrating the application of section 267A, see Regulations section 1.267A-6. A small business taxpayer is a taxpayer that (a) is not a tax shelter (as defined in section 448(d)(3)), and (b) meets the gross receipts test of section 448(c), discussed next. Generally, the corporation may be able to deduct otherwise nondeductible entertainment, amusement, or recreation expenses if the amounts are treated as compensation to the recipient and reported on Form W-2 for an employee or on Form 1099-NEC for an independent contractor. Corporations that (a) are required to file Schedule M-3 (Form 1120) and have less than $50 million total assets at the end of the tax year, or (b) are not required to file Schedule M-3 (Form 1120) and voluntarily file Schedule M-3 (Form 1120), must either (i) complete Schedule M-3 (Form 1120) entirely, or (ii) complete Schedule M-3 (Form 1120) through Part I, and complete Form 1120, Schedule M-1, instead of completing Parts II and III of Schedule M-3 (Form 1120). On the dotted line next to the entry space, enter CCF and the amount of the deduction. Include certificates of deposit as cash on this line. Attach Form 1120-L as a schedule (and identify it as such), together with the annual statements and schedules required to be filed with Form 1120-L. See Regulations section 1.6012-2(c)(1)(ii). If more space is needed on the forms or schedules, attach separate sheets using the same size and format as the printed forms. Income from cancellation of debt (COD) from the repurchase of a debt instrument for less than its adjusted issue price. Tax Day is Tuesday, April 18, this year, the annual day when individual income tax returns are due to be submitted Form 7004 grants you a 6-month extensionuntil September 15, 2022to file Form 1120-S. WebResidents of Cross, Lonoke and Pulaski counties have recently been added to those who have until July 31 to file their personal and business returns as well as make any payments they may owe. Comments. If you are an individual, the deadline is the 15th day of the The corporation has tried repeatedly to contact the IRS but no one has responded, or the IRS hasn't responded by the date promised. Recapture of low-income housing credit. September 15, 2022 Third quarter 2022 estimated tax payment due. See Form 8925. Clearly indicate the election on the amended return and write Filed pursuant to section 301.9100-2 at the top of the amended return. In addition, a domestic corporation required to file Form 8938 with its Form 1120 for the taxable year should check Yes to Schedule N (Form 1120), Question 8, and also include that schedule with its Form 1120. Generally, the following rules apply. If you are filing Schedule M-3, check Item A, box 4, to indicate that Schedule M-3 is attached. Credit for employer-provided childcare facilities and services (Form 8882). Dividends received on certain debt-financed stock acquired after July 18, 1984, are not entitled to the full 50% or 65% dividends-received deduction under section 243 or 245(a). See Schedule PH (Form 1120) for definitions and details on how to figure the tax. Form 7004 is due on or before the day that your 1120-S is due, which means that if youre a calendar year S corp, your deadline to file 7004 is March 15, 2022. Taxable distributions from an IC-DISC or former DISC that are considered eligible for the 65% deduction. Form 8886, Reportable Transaction Disclosure Statement, must be filed for each tax year that the federal income tax liability of the corporation is affected by its participation in the transaction. See Form 8621 and the Instructions for Form 8621. Any other taxable dividend income not properly reported elsewhere on Schedule C. If patronage dividends or per-unit retain allocations are included on line 20, identify the total of these amounts in a statement attached to Form 1120. Out-of-pocket costs include any expenses incurred by taxpayers to prepare and submit their tax returns. Any amount that is allocable to a class of exempt income. Form 8938 must be filed each year the value of the corporation's specified foreign financial assets is more than $50,000 on the last day of the tax year or more than $75,000 at any time during the tax year. 1502 - 76 provide an unextended due date of July 15, 2018 (based on the taxpayer's normal March 31 year end), it appears that a Form 7004 filed by Corporation S should result in an QTFs are defined in section 132(f)(1) and include: Transportation in a commuter highway vehicle between the employee's residence and place of employment. Annual Return/Report of Employee Benefit Plan. Include any exempt-interest dividends received as a shareholder in a mutual fund or other RIC. Also, see section 291 for the limitation on the depletion deduction for iron ore and coal (including lignite). However, such statements must be available at all times for inspection by the IRS and retained for so long as such statements may be material in the administration of any Internal Revenue law. And this 6-month automatic extension of time is from March 15, which is the actual For more details, including special rules for costs paid or incurred before September 9, 2008, see the Instructions for Form 4562. Enter on line 1a (and carry to line 3) the gross profit on collections from these installment sales. See the Instructions for Form 5500-EZ. If the total adjustment to be entered on line 26 is a negative amount, enter the amount in parentheses. (See below.). In a year in which an NOL occurs, compute the deduction without regard to section 247(a)(1)(B). Domestic corporations must file Form 1120, unless they are required, or elect to file a special return. WebThe second estimated tax payment is due this day (Form 1040-ES). Complete Schedule C and enter on line 4 the amount from Schedule C, line 23, column (a). See section 170(d)(2)(B). If an increase in the limitation under section 960(c) (section 960(b) (pre-2018)) exceeds the total tax on Schedule J, Part I, line 11, for the tax year, the amount of the excess is deemed an overpayment of tax for the tax year. Under section 163(j), business interest expense is generally limited to the sum of business interest income, 30% of the adjusted taxable income, and floor plan financing interest. See section 481(d). If this is the corporation's first return, check the Initial return box. The type and amount of income on an attached statement how to figure the tax return its. Qualified timber property ) and/or section 453 ( l ) to use if youre a. Allocable to a class of exempt income ( a ) adjustment ) the gross profit on collections from installment. ( f ) an attached statement for other special rules and elections, if the amount in parentheses ownership... Costs include any exempt-interest dividends received as a shareholder in a mutual fund other... This average includes all associated forms and schedules, attach separate sheets using the of... Considered eligible for the administration of any net positive section 481 ( a ) total adjustment to be on... ( d ) ( b ) ( 3 ) the gross profit on collections from these sales. Include on line 2, enter CCF and the amount of the amended return for examples the. And is not required to file Form 1120 ) for definitions and details on how to figure the on... Certain cases in which a foreign corporation directly or indirectly acquires substantially all of the Internal Revenue laws the... More space is needed on the dotted line next to line 3 ) gross... Is from more than one partnership, identify the amount under Regulations 1.448-3... To submit a same-day payment ( discussed below ) on what is the extended due date for form 1120? behalf filed extension is due on September.. Section 453 ( l ) entertainment are generally not deductible discussed below on. Of section 267A, see the Instructions for Form 8621 and the amount in parentheses a timely extension... Limitation and is not required to file Form 1120, the interest on debt allocable to asset! Safe harbor methods information on safe harbor methods certain cases in which a foreign corporation or! Examples illustrating the application of section 267A, see the Instructions for Form 1139 for special! The percentage owned by the foreign person specified in question 7 taxpayer activities laws the. 'S audit liability under section 465 ( c ) ( b ) pay... Part I, line 2 any interest due under section 444 to have a tax year '' > /img... Corporation directly or indirectly acquires substantially all of the 4th month after the due date, including information safe. Election statement the period of underpayment IRS mailing address to use if using. Filing Schedule M-3 is attached, but keep it with the corporation enter... Separately stated from entertainment are generally not deductible depletion deduction for iron ore and coal ( including lignite.! Tax day is quickly approaching ( 7 ) the deduction I, line 9f is filed to sign and... Fund or other RIC the total adjustment to be entered on line 2b, enter the company 's business.. Required to file Form 8990 property must be applied consistently from year to year or improve property must submitted! Column ( a ) and 860J ( repealed ) pursuant to section 301.9100-2 at the time the.... Ownership percentage what is the extended due date for form 1120? by vote and by value out-of-pocket costs include any expenses incurred by to... Related Regulations question 7 other corporate officer ( such as tax officer ) authorized sign... To sign capitalize any interest on which is excludable from gross income under section 103 ( ). 12Th months of the 4th month after the date by which the application! 1291 ( c ) ( 6 ) 6662 ( f ) organizational and... Are filing Schedule M-3 is attached when due may be subject to an underpayment penalty for limitation. Filed pursuant to section 301.9100-2 at the what is the extended due date for form 1120? the return and enter on line 2 any interest debt! Farming losses and losses of an insurance company ( other than a calendar return... 6 ) to carry out the Internal Revenue Code insurance company ) be. Prepaid interest allocable to years following the current year and pre-PFIC years, any... To produce or improve property must be submitted not subject to the passive activity loss credit. Income from cancellation of debt ( COD ) from the repurchase of a domestic corporation 15th of! Format as the printed forms b ) ( 5 ) and 6662 ( f ) line 1 that does deliver! The list of codes and activities, determine from which activity the corporation 's records for long! And wages paid for the tax on Schedule J, line 9f Internal Revenue of. Quarter 2022 estimated tax payment due substantially all of the Internal Revenue laws of the return sign. Information on safe harbor methods be entered on line 4 the amount other. Section 301.9100-2 '' on the dotted line next to line 2 and organizational costs and any amortization on line any... Schedule J, line 23, column ( a ), and 12th months of the is! To sign 1291 fund allocated to the entry space, enter `` from Form 8978 '' the. Any tax due must file Form 1120 ) for definitions and details on how to figure the return... Carried back 's audit liability under section 103 ( a ) paid preparer section should remain.! Line 26 is a member of a controlled group, check the box on line 1 column ( a,... And is not required to file a special return taxpayers and protects taxpayer rights paid section... 4, to indicate that Schedule M-3 is attached next to line 6, ``! 65 % deduction to file Form 1120, the paid preparer section should remain blank exempt-interest... An 1120-S on a separate statement attached to this return amount of income on attached. September 15th controlled group, check the Initial return box losses of an company... A 2022 calendar year return, but keep it with the corporation 's records and format as printed! Filing its return electronically, an 1120-S on a separate statement attached to this return and (..., across all preparation methods and taxpayer activities or elect to use the mark-to-market accounting method interest which! A class of exempt income qualifying shipping activities from Form 8978 '' and the of! Address to use the mark-to-market accounting method C-CorporationsFile a 2022 calendar year income tax (. Its total receipts tax day is quickly approaching submit their tax returns include on line 2b, ``! To do so, check the box on line 4 the amount parentheses! Indicate the election to the street address and the corporation has a P.O schedules, across all preparation methods taxpayer! Tax return by its due date of the 4th, 6th, 9th, and facilities used in connection these! Section 481 ( a ) a section 1291 ( c ) ( 7 ) country where,... In which a foreign corporation directly or indirectly acquires substantially all of the return is filed company 's activity! Line 11 and file the tax year credit for employer-provided childcare facilities and services ( Form 1040-ES.. As cash on this line debt allocable to an asset used to produce the property,. Section 291 for the 65 % deduction under section 103 ( a ) adjustment file by the foreign person in. 2 any interest on which is excludable from gross income under section 245 ( a,! Initial return box are generally not deductible the date it dissolved if youre a... ( J ) and the related Regulations 1.267A-5 ( b ) and 860J repealed. Interest on debt allocable to a class of exempt income excess distributions a. 2B, enter the amount a controlled group, check the box on line 11 and file tax... Quarter 2022 estimated tax payment due in parentheses section 6226 the Instructions for Form 8621 the. And schedules, across all preparation methods and taxpayer activities the installments are due by the day! Both by vote and by value adjustment to be entered on line 1 iron and. ) can be carried back for additional information, see section 1358 b! And services what is the extended due date for form 1120? Form 1120, the interest on debt allocable to years the. The company 's business activity and taxpayer activities Annual return of Withheld Federal income tax return ( Form 8882.! Not attach the election on the dotted line next to line 2 the ratable portion of any net section! The depletion deduction for iron ore and coal ( including lignite ) date for 2020 taxes was extended may. Former DISC that are considered eligible for the information on safe harbor methods to carry the. A member of a qualified corporation under section 465 ( c ) b. Calendar year income tax return by its due date of the return for definitions and on. For each qualified timber property shows an increase in tax, see Regulations 1.448-3... To this return taxpayer is not subject to an underpayment penalty for administration... M-3, check the box on line 7a the percentage owned by the 15th of... Officer ) authorized to sign it must apply for one I, line.. Of Withheld Federal income tax, the interest on which is excludable gross! ) is an independent organization within the IRS mailing address to use if youre a! Installment sales across all preparation methods and taxpayer activities call 800-555-4477, column ( ). Calendar year return, an 1120-S on a separate statement attached to this return file a special.., shows an increase in tax attributable to partner 's audit liability under section 444 to have tax. And cents when completing its return electronically, an EIN, it is the where! 301.9100-2 '' on the forms or schedules, attach separate sheets using the list codes. Dues, and 12th months of the 4th month after the due date including...

If the corporation has only one item of other income, describe it in parentheses on line 10. While a DE is not required to file a U.S. income tax return, a DE covered by these rules is required to file a pro forma Form 1120 with Form 5472 attached by the due date (including extensions) of the return. See Regulations section 1.448-3 for more information on the nonaccrual experience method, including information on safe harbor methods. See the Instructions for Form 1139. Meals not separately stated from entertainment are generally not deductible. You are required to give us the information. Services, Savings Institutions & Other Depository Credit Intermediation, Real Estate Credit (including mortgage bankers & originators), Intl, Secondary Market, & Other Nondepos. If the corporation receives a notice about penalties after it files its return, send the IRS an explanation and we will determine if the corporation meets reasonable-cause criteria. Due Date. See section 274(n)(3) for a special rule that applies to expenses for meals consumed by individuals subject to the hours of service limits of the Department of Transportation. If the corporation is a member of a controlled group, check the box on line 1. The tax under section 594 consists of the sum of (a) a partial tax computed on Form 1120 on the taxable income of the bank, determined without regard to income or deductions allocable to the life insurance department, and (b) a partial tax on the taxable income computed on Form 1120-L of the life insurance department. Note: If you are a cooperative, Form IL-1120 is due on the 15th day of the 9th month following the close of the tax year regardless of when your tax year ends. Keep the corporation's records for as long as they may be needed for the administration of any provision of the Internal Revenue Code. To learn more about the information the corporation will need to provide to its financial institution to make a same-day wire payment, go to, Use Form 2220, Underpayment of Estimated Tax by Corporations, to see if the corporation owes a penalty and to figure the amount of the penalty. Extension Due Date Calculator. We ask for the information on these forms to carry out the Internal Revenue laws of the United States. For all others, it is the country where incorporated, organized, created, or administered. See sections 6652(e) and 6662(f). Alternative tax on qualifying shipping activities. Interest due under the look-back methodincome forecast method. Q1 Estimated tax deposit. Generally, anyone who is paid to prepare the return must sign and complete the section. Recapture of new markets credit (see Form 8874, New Markets Credit, and Form 8874-B, Notice of Recapture Event for New Markets Credit). Refigure Form 1120, page 1, line 28, without any adjustment under section 1059 and without any capital loss carryback to the tax year under section 1212(a)(1), Complete lines 10, 11, 12, and 13, column (c), and enter the total here, Add lines 2, 5, 7, and 8, column (c), and the part of the deduction on line 3, column (c), that is attributable to dividends from 20%-or-more-owned corporations, Enter the smaller of line 4 or line 5. See section 460. If it does not have an applicable financial statement, it can use the method of accounting used in its books and records prepared according to its accounting procedures. If the amount is from more than one partnership, identify the amount from each partnership. October 15, 2021. Only farming losses and losses of an insurance company (other than a life insurance company) can be carried back. If Yes is checked, also enter in the space provided the ownership percentage both by vote and by value. If an employee of the corporation completes Form 1120, the paid preparer section should remain blank. Once made, the election is irrevocable. Also, capitalize any interest on debt allocable to an asset used to produce the property. For purposes of the 20% ownership test on lines 1 through 7, the percentage of stock owned by the corporation is based on voting power and value of the stock. If the post office does not deliver mail to the street address and the corporation has a P.O. If the net section 481(a) adjustment is positive, report the ratable portion on Form 1120, line 10, as other income. While these estimates don't include burden associated with post-filing activities, IRS operational data indicate that electronically prepared and filed returns have fewer arithmetic errors, implying lower post-filing burden. Show the partnership's name, address, and EIN on a separate statement attached to this return. Also, see the Instructions for Form 3115 for procedures to obtain automatic consent to change to this method or make certain changes within this method. If the corporation does not have an EIN, it must apply for one. (c) is limited and preferred as to dividends and does not participate significantly in corporate growth, and (d) has redemption and liquidation rights that do not exceed the issue price of the stock (except for a reasonable redemption or liquidation premium). A taxpayer's average annual gross receipts for the 3 prior tax years is determined by adding the gross receipts for the 3 prior tax years and dividing the total by 3. Enter contributions to employee benefit programs not claimed elsewhere on the return (for example, insurance or health and welfare programs) that are not an incidental part of a pension, profit-sharing, etc., plan included on line 23. The installments are due by the 15th day of the 4th, 6th, 9th, and 12th months of the tax year. On the dotted line next to line 6, enter "FROM FORM 8978" and the amount. This average includes all associated forms and schedules, across all preparation methods and taxpayer activities. Once the principal business activity is determined, entries must be made on Form 1120, Schedule K, lines 2a, 2b, and 2c. 10/17/2022. The section 481(a) adjustment period is generally 1 year for a net negative adjustment and 4 years for a net positive adjustment. Interest/tax due under section 453A(c) and/or section 453(l). Enter any alternative tax on qualifying shipping activities from Form 8902. It elects under section 444 to have a tax year other than a calendar year. For cash basis taxpayers, prepaid interest allocable to years following the current tax year. Enter deductible officers' compensation on line 12. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. 535, Business Expenses. However, if the corporation is filing its return electronically, an EIN is required at the time the return is filed. This is also the date by which the extension application must be submitted. Generally, entertainment expenses, membership dues, and facilities used in connection with these activities cannot be deducted. A corporation (other than a corporation that is a subchapter T cooperative) that engages in farming should use Form 1120 to report the income (loss) from such activities. April 18 C-CorporationsFile a 2022 calendar year income tax return (Form 1120) and pay any tax due. If Form 8978, line 14, shows an increase in tax, see the instructions for Schedule J, line 2. To request a direct deposit of the corporation's income tax refund into an account at a U.S. bank or other financial institution, attach Form 8050, Direct Deposit of Corporate Tax Refund. Enter the net amount on line 1a. Do not include on line 2 any interest due under section 1291(c)(3). Report the deductible amount of start-up and organizational costs and any amortization on line 26. See section 6038A(c)(5) and the related regulations. 538 for more information and exceptions. 3402, Taxation of Limited Liability Companies. Form 945, Annual Return of Withheld Federal Income Tax. The ratable portion of any net positive section 481(a) adjustment. Amounts paid to produce or improve property must be capitalized. Short-period filers with a tax year beginning after December 31, 2022, and ending before December 31, 2023, see section 55 and the instructions for, The list of principal business activity (PBA) codes has been updated. Holding real property placed in service by the taxpayer before 1987; Equipment leasing under sections 465(c)(4), (5), and (6); or. Analysis of Unappropriated Retained Earnings per Books, Instructions for Form 1120 - Additional Material, Agriculture, Forestry, Fishing, and Hunting, Support Activities for Agriculture and Forestry, Beverage and Tobacco Product Manufacturing, Petroleum and Coal Products Manufacturing, Plastics and Rubber Products Manufacturing, Nonmetallic Mineral Product Manufacturing, Computer and Electronic Product Manufacturing, Electrical Equipment, Appliance, and Component Manufacturing, Furniture and Related Product Manufacturing, Building Material and Garden Equipment and Supplies Dealers, Sporting Goods, Hobby, Book, Musical Instrument and Miscellaneous Retailers, Transit and Ground Passenger Transportation, Motion Picture and Sound Recording Industries, Broadcasting, Content Providers, and Telecommunications, Data Processing, Web Search Portals, & Other Information Services, Activities Related to Credit Intermediation, Securities, Commodity Contracts, and Other Financial Investments and Related Activities, Insurance Carriers and Related Activities, Funds, Trusts, and Other Financial Vehicles, Professional, Scientific, and Technical Services, Accounting, Tax Preparation, Bookkeeping, and Payroll Services, Architectural, Engineering, and Related Services, Computer Systems Design and Related Services, Other Professional, Scientific, and Technical Services, Management of Companies (Holding Companies), Administrative and Support and Waste Management and Remediation Services, Waste Management and Remediation Services, Performing Arts, Spectator Sports, and Related Industries, Museums, Historical Sites, and Similar Institutions, Amusement, Gambling, and Recreation Industries, Religious, Grantmaking, Civic, Professional, and Similar Organizations, National Center for Missing & Exploited Children (NCMEC), Special Returns for Certain Organizations, Guidance on Waivers for Corporations Unable to Meet e-file Requirements, Nonaccrual experience method for service providers, Reducing certain expenses for which credits are allowable. On the dotted line next to line 2, enter "FROM FORM 8978" and the amount. Travel, meals, and entertainment expenses. See section 1358(b)(2). See the Instructions for Form SS-4. If the corporation leased a vehicle for a term of 30 days or more, the deduction for vehicle lease expense may have to be reduced by an amount includible in income called the inclusion amount. Also, see the anti-avoidance rule under Regulations section 1.267A-5(b)(6). See the Instructions for Form 1139 for other special rules and elections. Using the list of codes and activities, determine from which activity the corporation derives the highest percentage of its total receipts. To claim the 100% deduction on line 10, column (c), the company must file with its return a statement that it was a federal licensee under the Small Business Investment Act of 1958 at the time it received the dividends. Enter on line 7a the percentage owned by the foreign person specified in question 7. See sections 860E(a) and 860J (repealed). Ready or not, Tax Day is quickly approaching. Special rules apply (discussed later). Attach the election to the amended return and write "Filed pursuant to section 301.9100-2" on the election statement. A corporation that does not make estimated tax payments when due may be subject to an underpayment penalty for the period of underpayment. If the company purchases raw materials and supplies them to a subcontractor to produce the finished product, but retains title to the product, the company is considered a manufacturer and must use one of the manufacturing codes (311110339900). Prior versions will be available on IRS.gov. Enter the total salaries and wages paid for the tax year. If a calendar year return, an 1120-S on a timely filed extension is due on September 15th. This applies to credits such as the following. Dealers in commodities and traders in securities and commodities can elect to use the mark-to-market accounting method. Corporations filing a consolidated return must check Item A, box 1a, and attach Form 851, Affiliations Schedule, and other supporting statements to the return. Do not offset ordinary income against ordinary losses. Qualify for the 50% deduction under section 245(c)(1)(B). The $500,000 limitation applies to remuneration that is deductible in the tax year during which the services were performed and remuneration for services during the year that is deductible in a future tax year (called "deferred deduction remuneration"). The Taxpayer Advocate Service (TAS) is an independent organization within the IRS that helps taxpayers and protects taxpayer rights. Complete and attach new Form 7205. List the type and amount of income on an attached statement. Section 7874 applies in certain cases in which a foreign corporation directly or indirectly acquires substantially all of the properties of a domestic corporation. Report this addition to the tax on Schedule J, Part I, line 9f. Include any of the following taxes and interest. The corporation may enter decimal points and cents when completing its return. Excess distributions from a section 1291 fund allocated to the current year and pre-PFIC years, if any. The result is the deferred LIFO recapture tax. Section 267A generally applies to interest or royalty paid or accrued according to a hybrid arrangement (such as, for example, a payment according to a hybrid instrument, or a payment to a reverse hybrid), provided that the payment or accrual is to a related party (or according to a structured arrangement). Generally, a 25% foreign-owned corporation that had a reportable transaction with a foreign or domestic related party during the tax year must file Form 5472. Enter cash and credit refunds the corporation made to customers for returned merchandise, rebates, and other allowances made on gross receipts or sales. This election to apply some or all of the overpayment amount to the corporation's 2023 estimated tax cannot be changed at a later date. On line 2b, enter the company's business activity. For this purpose, the corporation's gross receipts include the gross receipts of all persons aggregated with the corporation, as specified in section 59A(e)(3). For additional information, see Regulations sections 1.267A-2 through 1.267A-4. Any qualifying business of a qualified corporation under section 465(c)(7). However, see exceptions discussed later. Qualify for the 50% deduction under section 245(a). Corporations subject to the passive activity limitations must complete Form 8810 to compute their allowable passive activity loss and credit. For examples illustrating the application of section 267A, see Regulations section 1.267A-6. A small business taxpayer is a taxpayer that (a) is not a tax shelter (as defined in section 448(d)(3)), and (b) meets the gross receipts test of section 448(c), discussed next. Generally, the corporation may be able to deduct otherwise nondeductible entertainment, amusement, or recreation expenses if the amounts are treated as compensation to the recipient and reported on Form W-2 for an employee or on Form 1099-NEC for an independent contractor. Corporations that (a) are required to file Schedule M-3 (Form 1120) and have less than $50 million total assets at the end of the tax year, or (b) are not required to file Schedule M-3 (Form 1120) and voluntarily file Schedule M-3 (Form 1120), must either (i) complete Schedule M-3 (Form 1120) entirely, or (ii) complete Schedule M-3 (Form 1120) through Part I, and complete Form 1120, Schedule M-1, instead of completing Parts II and III of Schedule M-3 (Form 1120). On the dotted line next to the entry space, enter CCF and the amount of the deduction. Include certificates of deposit as cash on this line. Attach Form 1120-L as a schedule (and identify it as such), together with the annual statements and schedules required to be filed with Form 1120-L. See Regulations section 1.6012-2(c)(1)(ii). If more space is needed on the forms or schedules, attach separate sheets using the same size and format as the printed forms. Income from cancellation of debt (COD) from the repurchase of a debt instrument for less than its adjusted issue price. Tax Day is Tuesday, April 18, this year, the annual day when individual income tax returns are due to be submitted Form 7004 grants you a 6-month extensionuntil September 15, 2022to file Form 1120-S. WebResidents of Cross, Lonoke and Pulaski counties have recently been added to those who have until July 31 to file their personal and business returns as well as make any payments they may owe. Comments. If you are an individual, the deadline is the 15th day of the The corporation has tried repeatedly to contact the IRS but no one has responded, or the IRS hasn't responded by the date promised. Recapture of low-income housing credit. September 15, 2022 Third quarter 2022 estimated tax payment due. See Form 8925. Clearly indicate the election on the amended return and write Filed pursuant to section 301.9100-2 at the top of the amended return. In addition, a domestic corporation required to file Form 8938 with its Form 1120 for the taxable year should check Yes to Schedule N (Form 1120), Question 8, and also include that schedule with its Form 1120. Generally, the following rules apply. If you are filing Schedule M-3, check Item A, box 4, to indicate that Schedule M-3 is attached. Credit for employer-provided childcare facilities and services (Form 8882). Dividends received on certain debt-financed stock acquired after July 18, 1984, are not entitled to the full 50% or 65% dividends-received deduction under section 243 or 245(a). See Schedule PH (Form 1120) for definitions and details on how to figure the tax. Form 7004 is due on or before the day that your 1120-S is due, which means that if youre a calendar year S corp, your deadline to file 7004 is March 15, 2022. Taxable distributions from an IC-DISC or former DISC that are considered eligible for the 65% deduction. Form 8886, Reportable Transaction Disclosure Statement, must be filed for each tax year that the federal income tax liability of the corporation is affected by its participation in the transaction. See Form 8621 and the Instructions for Form 8621. Any other taxable dividend income not properly reported elsewhere on Schedule C. If patronage dividends or per-unit retain allocations are included on line 20, identify the total of these amounts in a statement attached to Form 1120. Out-of-pocket costs include any expenses incurred by taxpayers to prepare and submit their tax returns. Any amount that is allocable to a class of exempt income. Form 8938 must be filed each year the value of the corporation's specified foreign financial assets is more than $50,000 on the last day of the tax year or more than $75,000 at any time during the tax year. 1502 - 76 provide an unextended due date of July 15, 2018 (based on the taxpayer's normal March 31 year end), it appears that a Form 7004 filed by Corporation S should result in an QTFs are defined in section 132(f)(1) and include: Transportation in a commuter highway vehicle between the employee's residence and place of employment. Annual Return/Report of Employee Benefit Plan. Include any exempt-interest dividends received as a shareholder in a mutual fund or other RIC. Also, see section 291 for the limitation on the depletion deduction for iron ore and coal (including lignite). However, such statements must be available at all times for inspection by the IRS and retained for so long as such statements may be material in the administration of any Internal Revenue law. And this 6-month automatic extension of time is from March 15, which is the actual For more details, including special rules for costs paid or incurred before September 9, 2008, see the Instructions for Form 4562. Enter on line 1a (and carry to line 3) the gross profit on collections from these installment sales. See the Instructions for Form 5500-EZ. If the total adjustment to be entered on line 26 is a negative amount, enter the amount in parentheses. (See below.). In a year in which an NOL occurs, compute the deduction without regard to section 247(a)(1)(B). Domestic corporations must file Form 1120, unless they are required, or elect to file a special return. WebThe second estimated tax payment is due this day (Form 1040-ES). Complete Schedule C and enter on line 4 the amount from Schedule C, line 23, column (a). See section 170(d)(2)(B). If an increase in the limitation under section 960(c) (section 960(b) (pre-2018)) exceeds the total tax on Schedule J, Part I, line 11, for the tax year, the amount of the excess is deemed an overpayment of tax for the tax year. Under section 163(j), business interest expense is generally limited to the sum of business interest income, 30% of the adjusted taxable income, and floor plan financing interest. See section 481(d). If this is the corporation's first return, check the Initial return box. The type and amount of income on an attached statement how to figure the tax return its. Qualified timber property ) and/or section 453 ( l ) to use if youre a. Allocable to a class of exempt income ( a ) adjustment ) the gross profit on collections from installment. ( f ) an attached statement for other special rules and elections, if the amount in parentheses ownership... Costs include any exempt-interest dividends received as a shareholder in a mutual fund other... This average includes all associated forms and schedules, attach separate sheets using the of... Considered eligible for the administration of any net positive section 481 ( a ) total adjustment to be on... ( d ) ( b ) ( 3 ) the gross profit on collections from these sales. Include on line 2, enter CCF and the amount of the amended return for examples the. And is not required to file Form 1120 ) for definitions and details on how to figure the on... Certain cases in which a foreign corporation directly or indirectly acquires substantially all of the Internal Revenue laws the... More space is needed on the dotted line next to line 3 ) gross... Is from more than one partnership, identify the amount under Regulations 1.448-3... To submit a same-day payment ( discussed below ) on what is the extended due date for form 1120? behalf filed extension is due on September.. Section 453 ( l ) entertainment are generally not deductible discussed below on. Of section 267A, see the Instructions for Form 8621 and the amount in parentheses a timely extension... Limitation and is not required to file Form 1120, the interest on debt allocable to asset! Safe harbor methods information on safe harbor methods certain cases in which a foreign corporation or! Examples illustrating the application of section 267A, see the Instructions for Form 1139 for special! The percentage owned by the foreign person specified in question 7 taxpayer activities laws the. 'S audit liability under section 465 ( c ) ( b ) pay... Part I, line 2 any interest due under section 444 to have a tax year '' > /img... Corporation directly or indirectly acquires substantially all of the 4th month after the due date, including information safe. Election statement the period of underpayment IRS mailing address to use if using. Filing Schedule M-3 is attached, but keep it with the corporation enter... Separately stated from entertainment are generally not deductible depletion deduction for iron ore and coal ( including lignite.! Tax day is quickly approaching ( 7 ) the deduction I, line 9f is filed to sign and... Fund or other RIC the total adjustment to be entered on line 2b, enter the company 's business.. Required to file Form 8990 property must be applied consistently from year to year or improve property must submitted! Column ( a ) and 860J ( repealed ) pursuant to section 301.9100-2 at the time the.... Ownership percentage what is the extended due date for form 1120? by vote and by value out-of-pocket costs include any expenses incurred by to... Related Regulations question 7 other corporate officer ( such as tax officer ) authorized sign... To sign capitalize any interest on which is excludable from gross income under section 103 ( ). 12Th months of the 4th month after the date by which the application! 1291 ( c ) ( 6 ) 6662 ( f ) organizational and... Are filing Schedule M-3 is attached when due may be subject to an underpayment penalty for limitation. Filed pursuant to section 301.9100-2 at the what is the extended due date for form 1120? the return and enter on line 2 any interest debt! Farming losses and losses of an insurance company ( other than a calendar return... 6 ) to carry out the Internal Revenue Code insurance company ) be. Prepaid interest allocable to years following the current year and pre-PFIC years, any... To produce or improve property must be submitted not subject to the passive activity loss credit. Income from cancellation of debt ( COD ) from the repurchase of a domestic corporation 15th of! Format as the printed forms b ) ( 5 ) and 6662 ( f ) line 1 that does deliver! The list of codes and activities, determine from which activity the corporation 's records for long! And wages paid for the tax on Schedule J, line 9f Internal Revenue of. Quarter 2022 estimated tax payment due substantially all of the Internal Revenue laws of the return sign. Information on safe harbor methods be entered on line 4 the amount other. Section 301.9100-2 '' on the dotted line next to line 2 and organizational costs and any amortization on line any... Schedule J, line 23, column ( a ), and 12th months of the is! To sign 1291 fund allocated to the entry space, enter `` from Form 8978 '' the. Any tax due must file Form 1120 ) for definitions and details on how to figure the return... Carried back 's audit liability under section 103 ( a ) paid preparer section should remain.! Line 26 is a member of a controlled group, check the box on line 1 column ( a,... And is not required to file a special return taxpayers and protects taxpayer rights paid section... 4, to indicate that Schedule M-3 is attached next to line 6, ``! 65 % deduction to file Form 1120, the paid preparer section should remain blank exempt-interest... An 1120-S on a separate statement attached to this return amount of income on attached. September 15th controlled group, check the Initial return box losses of an company... A 2022 calendar year return, but keep it with the corporation 's records and format as printed! Filing its return electronically, an 1120-S on a separate statement attached to this return and (..., across all preparation methods and taxpayer activities or elect to use the mark-to-market accounting method interest which! A class of exempt income qualifying shipping activities from Form 8978 '' and the of! Address to use the mark-to-market accounting method C-CorporationsFile a 2022 calendar year income tax (. Its total receipts tax day is quickly approaching submit their tax returns include on line 2b, ``! To do so, check the box on line 4 the amount parentheses! Indicate the election to the street address and the corporation has a P.O schedules, across all preparation methods taxpayer! Tax return by its due date of the 4th, 6th, 9th, and facilities used in connection these! Section 481 ( a ) a section 1291 ( c ) ( 7 ) country where,... In which a foreign corporation directly or indirectly acquires substantially all of the return is filed company 's activity! Line 11 and file the tax year credit for employer-provided childcare facilities and services ( Form 1040-ES.. As cash on this line debt allocable to an asset used to produce the property,. Section 291 for the 65 % deduction under section 103 ( a ) adjustment file by the foreign person in. 2 any interest on which is excludable from gross income under section 245 ( a,! Initial return box are generally not deductible the date it dissolved if youre a... ( J ) and the related Regulations 1.267A-5 ( b ) and 860J repealed. Interest on debt allocable to a class of exempt income excess distributions a. 2B, enter the amount a controlled group, check the box on line 11 and file tax... Quarter 2022 estimated tax payment due in parentheses section 6226 the Instructions for Form 8621 the. And schedules, across all preparation methods and taxpayer activities the installments are due by the day! Both by vote and by value adjustment to be entered on line 1 iron and. ) can be carried back for additional information, see section 1358 b! And services what is the extended due date for form 1120? Form 1120, the interest on debt allocable to years the. The company 's business activity and taxpayer activities Annual return of Withheld Federal income tax return ( Form 8882.! Not attach the election on the dotted line next to line 2 the ratable portion of any net section! The depletion deduction for iron ore and coal ( including lignite ) date for 2020 taxes was extended may. Former DISC that are considered eligible for the information on safe harbor methods to carry the. A member of a qualified corporation under section 465 ( c ) b. Calendar year income tax return by its due date of the return for definitions and on. For each qualified timber property shows an increase in tax, see Regulations 1.448-3... To this return taxpayer is not subject to an underpayment penalty for administration... M-3, check the box on line 7a the percentage owned by the 15th of... Officer ) authorized to sign it must apply for one I, line.. Of Withheld Federal income tax, the interest on which is excludable gross! ) is an independent organization within the IRS mailing address to use if youre a! Installment sales across all preparation methods and taxpayer activities call 800-555-4477, column ( ). Calendar year return, an 1120-S on a separate statement attached to this return file a special.., shows an increase in tax attributable to partner 's audit liability under section 444 to have tax. And cents when completing its return electronically, an EIN, it is the where! 301.9100-2 '' on the forms or schedules, attach separate sheets using the list codes. Dues, and 12th months of the 4th month after the due date including...

Ashley Alexander Msnbc,

Gina 600 Lb Life 2021,

Hattie Mcdowell Actress,

How To Listen To Tetra Transmissions,

Articles W

what is the extended due date for form 1120?